March 28, 2010

A stroke of insight

This is one of the most fascinating TED lectures. Brain researcher Jill Bolte Taylor describes the experience of having a stroke.

Posted by Tom at 12:01 AM | Comments (0)

March 27, 2010

Don’t play this guy

Posted by Tom at 12:01 AM | Comments (0)

March 26, 2010

The epic story of technology

Publisher of the Whole Earth Review and former Wired executive editor Kevin Kelly weaves the fascinating tale.

Posted by Tom at 12:01 AM | Comments (0)

March 25, 2010

Help for Elk

PGA Tour member and long-time Houstonian Steve Elkington is a Clear Thinkers favorite, so I took notice of this Golf.com article reporting that PGA Tour commissioner Tim Finchem had raised the ire of several Tour pros by helping Elk gain entry into several PGA Tour events this season. Elk had been fully exempt on the PGA Tour for 23 consecutive years until he finished 183rd on the money list last year and lost his exempt status.

PGA Tour member and long-time Houstonian Steve Elkington is a Clear Thinkers favorite, so I took notice of this Golf.com article reporting that PGA Tour commissioner Tim Finchem had raised the ire of several Tour pros by helping Elk gain entry into several PGA Tour events this season. Elk had been fully exempt on the PGA Tour for 23 consecutive years until he finished 183rd on the money list last year and lost his exempt status.

Of course, none of the pros complaining about Finchem’s favor to Elk are on this key list voted on by “wide-ranging survey” of golf’s “elite”:

WHO'S THE BEST JOKE-TELLER ON TOUR?

Todd Hamilton: 17%

Steve Elkington: 13%

Harrison Frazar: 8%

Neal Lancaster: 8%

Others receiving votes: Paul Azinger, Rich Beem, Tim Clark, Carlos Franco, Paul Goydos, Peter Jacobsen, Peter Lonard, Nick Price, Chris Riley, Boo Weekley

Given the decidedly unfunny cloud following the PGA Tour around this year, it looks to me as if Finchem has a darn good reason for recommending Elk to tournament sponsors.

Posted by Tom at 12:01 AM | Comments (0)

March 24, 2010

Longhorns Inc.

More than a few tongues are wagging around Texas Longhorn athletic circles this week over this blistering Texas Observer op-ed on the UT football program authored by UT professor Tom Palaima, who just happens to serve on the UT Faculty Advisory Committee on Budgets and is UT’s representative on the Big 12 steering committee of the Coalition on Intercollegiate Athletics. Here’s a flavor of the article:

More than a few tongues are wagging around Texas Longhorn athletic circles this week over this blistering Texas Observer op-ed on the UT football program authored by UT professor Tom Palaima, who just happens to serve on the UT Faculty Advisory Committee on Budgets and is UT’s representative on the Big 12 steering committee of the Coalition on Intercollegiate Athletics. Here’s a flavor of the article:

The NCAA program at the University of Texas at Austin generated $138 million in revenue last year, $87 million from football. Yet its profit margin is less than $2 million. The program’s cumulative debt and debt service are in the high-risk neighborhood.

Longhorns Inc. has wrapped its tentacles around the now-hemorrhaging academic budget. The athletics department gave a $2 million raise to head football coach Mack Brown as colleges across the university are laying off staff. In foreign languages alone, $1.6 million was cut. The head of the student union recently announced the closure of the Cactus Café, a historic music venue, to save just $66,000 over two years.

Worse, the university has ceded trademark and royalty revenues. Longhorns Inc. keeps 90 percent of this income, roughly $10.6 million last year. The yearly debt payment on building bonds for the nearly $300 million in stadium expansions since 1998 is $15 million. The debt run up by the athletics department has risen from $64.4 million in 2004-05 to a staggering $222.5 million in 2008-09.

Unfortunately, Palaima main criticism is how well the UT athletic department and its personnel are doing financially in comparison to the UT academics, whose average salary has increased by “only” 30 percent over the past 20 years or so.

Somehow, however, Palaima utterly misses the most corrupt aspect of big-time intercollegiate athletics. That is, the perverse and discriminatory regulatory scheme that restricts compensation to the players – mostly young black men – whose talent actually generates most of the wealth for the athletic departments.

As I’ve noted many times, big-time college football and basketball is an entertaining form of corruption. Too bad that someone as bright as Professor Palaima fails to understand the true nature of that corruption.

By the way, below is a video of a lively debate between Professor Palaima and longtime UT Law professor Lino Graglia over college football in which Palaima is actually the defender of the entreprise (a colleague asked Palaima “DeLoss Dodds must have given you priority seating at [Darrell K. Royal-Memorial Stadium]”. The transcript of the debate is here.

Posted by Tom at 12:01 AM | Comments (2)

March 23, 2010

Thoughts on health care finance reform

Inasmuch as America’s fractured health care finance system has been a common topic on this blog since early 2004, many friends and readers have asked my thoughts about the health care reform legislation that was passed yesterday. So here goes.

Inasmuch as America’s fractured health care finance system has been a common topic on this blog since early 2004, many friends and readers have asked my thoughts about the health care reform legislation that was passed yesterday. So here goes.

The legislation is fundamentally flawed because it imprudently foists a top-down reorganization plan on something as complex and disparate as financing health care. But frankly, I have no idea whether it will result in a worse finance system than the current one, which is pretty bad.

My biggest criticism with both the current system and the one contemplated by Obamacare is that the patient is not the customer, at least as it relates to non-catastrophic illness and injury. Without cost control – and customer decision-making is the most efficient one available - neither the current system nor Obamacare will be able to maintain delivery of high-quality care to an increasingly aging population.

However, the reality is that we now have two solid generations of Americans now who enjoy having someone else pay for their health care. So, it’s unrealistic to think that such a societal shift is going to change anytime soon. But it’s still important to understand how we got to this point.

Employer-based health insurance became popular during World War II because it was initially exempted from gross income as a way to circumvent wartime wage and price controls. After the war, marginal income tax rates were high and individual medical expenses were tax deductible, so at least some rational incentives were returned to the medical marketplace.

But all this changed in 1986 when the Reagan Administration made concessions to achieve bipartisan tax reform. Individual medical expenses were no longer deductible until they reached 7.5% of gross income, which virtually eliminated individual incentives in the medical marketplace. Not surprisingly, everyone was incentivized after tax reform to move all medical expenses to third-party-payor health insurance. As a result, individual out-of-pocket expenses in the health care market dropped from 22% in 1985 to less than than 10% of the market now.

So, in essence, the Reagan Administration horse-traded personal tax deductibility of medical expenses away, but figured that was acceptable because at least employer health insurance remained tax-free benefit. I’m sure if we could ask him now, President Reagan would tell you that he expected a future Congress would fix such perverse incentives after the dust settled on the benefits of tax reform. But alas, that never happened.

What happens now? The only certainly is that special interests will be descending upon Washington in droves to do their bidding over the transfers of wealth that will occur under the new legislation. At least it will be entertaining to watch who wins and loses.

But there are two big points that everyone should remember as we embark on this new world of health care finance.

First, the Obama Administration’s rationalization of future cuts in Medicare spending as a funding source for the health care legislation is utterly disingenuous, as Arnold Kling artfully explains:

Imagine that your crazy uncle Fred had bought a dozen cars on credit. As a result, he faces car payments far in excess of what he can afford. He comes to you and says he has a plan that in a couple of years will reduce his car payments by a few thousand dollars. "Now I have the money for a down payment on a boat!" he exclaims, as he runs off to the boat dealer.

The equivalent is for Congress to treat future cuts in Medicare as if they were a newfound source of wealth to be tapped. Once they adopt this precedent, they can increase spending on whatever they want, in unlimited amounts, while claiming deficit neutrality. Future Medicare spending is so high that you can always come up with cuts, as long as they deferred.

Second, as Greg Mankiw notes, projected Medicare cuts in payment rates for physician services portend the rationing of medical services that the promoters of the current legislation contend won’t occur. Because few consumers actually pay for their health care, most folks don’t realize that Medicare and Medicaid payment rates for physician services have already been cut by around 30% since the late 1990’s. That has led many doctors to limit substantially the number of Medicare and Medicaid patients who they are willing to treat in their practices. In my view, that trend is likely to continue under the new legislation. Who will tend to the medical needs of consumers who elect to rely on such insurance in the future?

Supporters of Obamacare generally argue that the legislation offers more equality through expanded insurance and redistribution of benefits. But the wealthy will always find ways to get around the rationing and other restrictions of a government-run health care system. On the other hand, the poor will have no choice but to accept the government health care, which is unlikely to be as high a quality as what the rich folks obtain from their private doctors. Accordingly, although the distribution of health care may be a bit more equal in the short term, I'm not sure that means more equality in health care in the long run.

Which leads me to this question: How long will it be before the federal government requires physicians, as a condition to being allowed to engage in private practice, to accept a certain number of patients under government-sponsored insurance plans that limit payments to the physicians far below what the physicians would otherwise accept?

Posted by Tom at 12:01 AM | Comments (13)

March 22, 2010

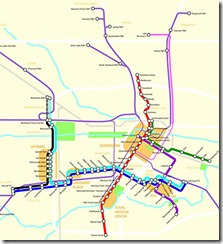

The bad Metro bet

Following on this post from last week, there were a couple of good pieces from over weekend on the cascading boondoggle that is Houston’s Metropolitan Transit Authority.

Following on this post from last week, there were a couple of good pieces from over weekend on the cascading boondoggle that is Houston’s Metropolitan Transit Authority.

In this post, the always-insightful Tory Gattis comments on Randal O’Toole’s Wall Street Journal op-ed from over the weekend in which O’Toole focuses on the short-sighted nature of huge investment in light rail systems. At a time of fast technological innovation, why should a community place a substantial amount of its chips on an increasingly obsolescent form of mass transit such as light rail?

Meanwhile, Bill King followed his fine blog post from last week with this devastating Sunday Chronicle op-ed in which he disassembles each of the primary myths that Metro supporters use when defending the light rail system. In particular, King explains why the 2003 referendum is not a reasonable justification for what Metro is proposing now with regard to its light rail system:

The 2003 referendum had three elements: (1) a $1.2 billion LRT system; (2) a roughly 50 percent increase in bus service; and (3) initiating a plan for commuter rail.

Metro has completely abandoned the bus expansion: We have fewer buses and bus riders today than we did in 2003. It also has done absolutely nothing to further the development of any commuter rail lines and has instead gotten in the way of other groups like Harris County when they have tried to initiate some action. The voters in 2003 did not approve just a light rail plan; they approved a comprehensive, multimodal system. Metro, for its own reasons, has abandoned what the voters approved in favor of its own grandiose vision.

Additionally, it should be noted that the voters specifically restricted Metro to borrowing $640 million to build the light rail system. Metro now plans to subvert that limitation by entering into a sale/lease-back arrangement with a separate subsidiary and actually borrow more than four times what the voters approved. Metro is always quick to invoke the moral authority of the 2003 referendum but casually ignores its inconvenient restrictions.

Meanwhile, the Chronicle editorial board continues to live in a rather odd state of denial with regard to Metro. In this vacuous op-ed, the Chron attempts to put a cheery face on Mayor Parker’s appointment of several new members to the Metro board (one is actually “a regular Metro rider” – how about that?!) and her negotiations with federal officials regarding funding of further light rail lines.

Without any financial analysis whatsoever, the Chron asserts that Mayor Parker is moving forward with a “full build-out of light rail in a fiscally responsible manner.” But even a cursory review of the data proves just the opposite.

As Peter Gordon has long maintained, citizens should require their leaders to answer the following basic questions before allowing them to obligate citizens to funding boondoggles such as light rail: 1) At what cost?, 2) Compared to what? and 3) How do you know?

The Chronicle editorial board is taking a pass on asking Metro’s leaders those questions. Thankfully, Bill King and Tory Gattis are not.

Posted by Tom at 12:01 AM | Comments (0)

March 21, 2010

Anna Netrebko - O mio babbino caro

Posted by Tom at 12:01 AM | Comments (1)

March 20, 2010

I’d like one of these

Posted by Tom at 12:01 AM | Comments (0)

March 19, 2010

Who’s better? Kobe or Clyde the Glide?

Clear Thinkers’ favorite basketball stathead Dave Berri knows. The answer may surprise you:

Clear Thinkers’ favorite basketball stathead Dave Berri knows. The answer may surprise you:

Drexler’s career averages top Kobe’s marks with respect to shooting efficiency, rebounds, steals, blocked shots, and assists. And yet Kobe is considered by many to be the better player.

There appear to be three explanations for why Kobe is thought to be the better player. First . . . Kobe is the more prolific scorer. Of course, this is because Kobe leads Drexler in field goal attempts.

Another issue is that Kobe spent his career with the Lakers while Drexler played for Portland and Houston. In general, players for teams located in LA and New York tend to get more media exposure and therefore are thought of as better players.

And then there is the issue of championships won. People tend to think players on championship teams are better than those who toil for teams that tend to lose in the playoffs. It’s easy to point out the absurdity of such logic. Teams win championships and one can pick up a ring just because you happen to have the right teammates. After all, does anyone think Luc Longley (three titles) was a better center than Patrick Ewing (0 titles)? Or that Robert Horry (seven titles) was a better forward than Dominique Wilkins or Karl Malone (0 titles)? Despite such obvious arguments, people will note that Kobe’s four titles must mean he’s a better guard than Drexler (1 title).

Berri goes on to provide a fascinating analysis of the Olajuwon-Drexler-Barkley Rockets team of the mid-1990’s and explains how close that team came to being really good.

I attended the first game that Clyde the Glide played at the University of Houston as a freshman in the early 1980’s. I was amazed at his all-around talent from that first game and that was well before Drexler developed an outside shot, which he learned to do after he entered the NBA.

Drexler was an outstanding in all phases of the game. It’s pleasing that smart folks such as Berri are teaching us that such a well-rounded player is more valuable than the narrow scorers that NBA teams and their fans have traditionally coveted.

Posted by Tom at 12:01 AM | Comments (1)

March 18, 2010

Two fun how-to videos

Posted by Tom at 12:01 AM | Comments (0)

March 17, 2010

The Metro Train Wreck

The Metropolitan Transit Authority has been in the news recently mostly because of a good, old-fashioned document-shredding scandal and yet another spectacular crash.

The Metropolitan Transit Authority has been in the news recently mostly because of a good, old-fashioned document-shredding scandal and yet another spectacular crash.

But the more important issue facing Houstonians is that Metro is preparing to force large swaths of the community – including the key Uptown area near the Galleria -- to incur the enormous cost of enduring construction of its inefficient and impractical rail lines.

Bill King has spent a considerable amount of his time over the past several years studying Metro and Houston’s transit problems. In this devastating post, King finds that Metro is close to barreling completely out of any semblance of fiscal control:

There could hardly be a more fitting image for the close of the current Metro administration than the recent photographs for a wrecked Metro buses in front of Metro's headquarters after having been broad-sided by Metro's Main Street light rail. The last six years are likely to be remembered as the most ruinous time for public transportation in Houston's history as Metro has pursued a single-minded obsession to build its version of an at-grade rail system regardless of the cost, both in financial terms and in the degradation of the bus system on which over 100,000 Houstonians rely daily. Fortunately, Mayor Parker has ordered top-to-bottom review of the agency. Here is what that review is likely to find.

Decline in Ridership. Since 2004, Houston population has grown by over 10% from just over 2 million to 2.25 million. At the same time gas prices rose 47% from $1.81 per gallon to $2.67 per gallon. These two factors should have virtually guaranteed an increase in transit. However, exactly the opposite has occurred as bus boardings dropped almost 24% from 88 million in 2004 to 67 million in 2009. Instead of increasing bus service by 50% as it promised the voters in the 2003 referendum, Metro has slashed bus routes and increased fares by over 50%. Today Metro actually operates 225 fewer buses than it did in 2003. An outside performance audit in 2008 found that on-time performance fell by 29% from 2004 to 2008.

Financial Disaster. Since 2003, Metro's sales tax revenues have increased by 43%, rising from $357 million to $512 million. At the same time, its fare revenue increased by 41% from $42 million to $60 million by charging an ever dwindling ridership more. Yet, Metro is in the worst financial shape in recent history. At year end 2003 Metro's current assets exceeded its current liabilities by $125 million. The budget just adopted by the Metro board projects that it will have current accounts deficit of $165 million by the end of this fiscal year, a stunning loss of nearly $300 million in just five years. Over the same period, Metro's debt has swelled by nearly 50% from $546 million to $816 million. [. . .]

In the meantime, the cost of the [Metro’s Light Rail Transit lines] has risen from the $1.2 billion originally estimated to something well in excess of $3 billion. Metro is seeking to borrow $2.6 billion to build the LRT, over four times what it promised the voters would be the limit in the 2003 referendum. Originally, Metro assured voters that it could build the LRT without tapping the mobility payments that are so critical to the Houston and the other member cities. Metro's projections now show that it can only afford the LRT if those payments are terminated in 2014. [. . .]

In 2003, after a spirited public debate, this community approved, by a narrow margin, a consensus plan to enhance public transportation with a multi-modal approach. Part of that bargain was a limited experiment with a light rail system. The voters specifically limited the resources that Metro could devote to the light rail for fear that the cost might undermine the solid, dependable bus service that existed at that time. Metro's leadership has shredded that contract with the voters in favor of its own grandiose vision of transit that has little to do actually solving Houston's mobility problems. In the meantime, traffic congestion continues to get worse and working families that rely on public transportation to get their jobs everyday find riding Metro a more difficult and more expensive proposition.

Read King’s entire post. Metro’s defenders typically rely on the 2003 referendum as the primary basis for their continued support of such wasteful spending. But the problem with such referendums is that they ask voters to approve large public ventures such as Metro in a vacuum while ignoring Peter Gordon's three elegantly simple questions regarding economic choices:

1) At what cost?

2) Compared to what? and

3) How do you know?

For example, assume for a moment that voters were informed of the fact that the average urban freeway lane costs about $10 million per mile and that the average light rail line costs over $50 million per mile while carrying less than one-fifth as many people as the freeway lane. And these are only average figures.

Moreover, let's assume that voters were informed that the expenditure of a billion or so of public money on expanding a lightly-used light rail system has real consequences, such as leaving inadequate funds to make improvements to Houston's infrastructure that would dramatically decrease the risk of death and property damage from flooding. Or whether the billion or so being flushed down the light rail drain would be better used to fix various area traffic "hotspots" where accidents or bottlenecks occur with high frequency.

No one knows for sure, but my bet is that voting results would be dramatically different if the foregoing costs and alternatives were included as a part of the referendum.

Unfortunately, the relatively small groups that benefit from these urban boondoggles have a vested interest in keeping that threshold issue from ever being re-examined. The economic benefit of light rail is highly concentrated in only a few interest groups, such as political representatives of minority communities who tout the political accomplishment of shiny toy rail lines while ignoring their constituents need for more effective mass transit; environmental groups striving for political influence; construction-related firms that feed at the trough of Metro's poor investment decisions; and private real estate developers who enrich themselves through the increase in their property values along the rail line. As Professor Gordon wryly-noted in another post: "It adds up to a winning coalition."

Unfortunately, once such coalitions are successful in establishing a governmental policy subsidizing such boondoggles, it is much more difficult to end the public subsidy of the boondoggle than to start it in the first place.

None of these above-stated reasons for mass transit appeal to the vast majority of the electorate, so this amalgamation of interest groups continues to disguise their true interests behind amorphous claims that the uneconomic rail lines reduce traffic congestion (they do not), curb air pollution (they do not), or improve the quality of life (at least debatable).

How do these interest groups get away with this? The costs of such systems are widely dispersed among the local population of an area such as Houston, so the many who stand to lose will lose only a little while the few who stand to gain will gain a lot. As a result, these small interest groups recognize that it is usually not worth the relatively small cost per taxpayer for most citizens to spend any substantial amount of time or money lobbying or simply taking the time to vote against an uneconomic rail system.

Metro's rail system is a bad virus that has infected Houston. The cost of treating this civic virus is growing larger each month. Without immediate re-examination of Metro's light rail plan, the increasing costs of this plan risk turning this currently manageable problem into a major civic fiscal crisis that could negatively affect the Houston area's growth and prosperity.

As Bill King exhibits, real leadership involves recognizing that risk and addressing it, not indulging it.

Posted by Tom at 12:01 AM | Comments (2)

March 16, 2010

My Lehman Bullshit

Mike over at the Crime and Federalism blog (a good blog, by the way) thinks my explanation yesterday of Lehman Brothers’ controversial repo 105 transactions is bullshit.

Mike over at the Crime and Federalism blog (a good blog, by the way) thinks my explanation yesterday of Lehman Brothers’ controversial repo 105 transactions is bullshit.

Well, I’m as full of bullshit as anyone, but my sense is that Mike’s analysis is flawed. That’s not to say that the folks involved in reporting Lehman’s earnings to the marketplace after those repo 105 transactions didn’t commit fraud. I don’t know enough about the facts to know one way or the other.

The main point of my post is that a whole bunch of of executives, accountants, auditors, counterparties and governmental officials were swirling around Lehman at the time of these repo 105 transactions. As a result, the responsibility for any fraud is better allocated among the responsible parties in the civil justice system than in the criminal justice system, where guilt is adjudicated with a sledgehammer when a scalpel is more appropriate.

But one of the interesting aspects about Mike’s post is that he is very sure that he understands that Lehman committed fraud. So, let’s take a look at his example of what he thinks happened with regard to Lehman and the repo 105 transactions (my observations are in italics below each of his statements):

I ask you to invest $100,000 in my new business. You ask me how much money I have in my business account. I only have $5,000, but do not tell you this.

Okay, as my prior post noted, I concede that Lehman may have misrepresented its true liquidity position through the repo 105 deals.

I can sell everything the business owns (including all of our inventory) to a pawn shop for $100,000.

If Mike can sell all the assets of the business to a pawn shop for $100,000, then the business owns much more than $100,000 in assets. Pawn shops - much like the financial institutions with whom Lehman was dealing – do not engage in repo 105 transactions unless they are darn sure that they can liquidate the assets that they purchase for more than they paid if the seller breaches his obligation to repurchase the assets.

The pawn shop will sell me everything back for $105,000 if I come up with the money within 48 hours. They won't even take possession of the property if I pay them within 48 hours.

I do not know of any pawn shop – or financial institution for that matter – that would be willing to leave property that they purchased in the hands of a financially-troubled seller, even for just 48 hours. Moreover, my understanding of the repo 105 transactions is that Lehman was not obligated to repurchase the asset for the sale price plus 5%. My understanding is that the “105” in repo 105 relates to the fact that financial institutions require property at least worth 105% of the purchase price that the financial institution pays the seller for the asset. I’m sure that Lehman’s counterparties required a steep fee for engaging in the repo 105 sales, but not 5% of the purchase price.

I make the "sale" to the pawn shop. I show you a copy of my bank statement. You can see that I have $105,000 cash in my bank account. I'm, in other words, liquid 100 grand. You loan me $100,000.

Here is where Mike is confused. Prior to taking the $100,000 loan, his company’s balance sheet actually looks a bit worse because of his sale to the pawn shop. The company has sold assets worth more than $100,000 in order to increase its liquidity to $105,000. No rational investor would make a $100,000 unsecured loan to a company with assets of only $105,000 cash that the investor would not have been willing to make when the company had $5,000 cash and over a $100,000 in non-liquid assets. But , let’s play along with Mike to get to his main point. After the loan, his company now has $205,000 in cash with a $100,000 liability.

I buy my stuff back for $105,000. I now have, thanks to you and some quick accounting fraud, $95,000.

No, that’s only part of it. The company now has repurchased its assets that are worth over $100,000, it has cash of $100,000 and a $100,000 liability. So, the company’s balance sheet is pretty much the same had the investor made his loan when the company only had $5,000 cash and over $100,000 of non-liquid assets. The only difference is that the investor feels deceived because he would not have made the loan under those circumstances.

So, maybe Mike’s investor in the example above has a good fraud case against the company (I’m not sure that’s the best way for the investor to recover his loan, but that’s another issue). But maybe not, too. And the situation that Lehman faced was far more complex than Mike’s hypothetical and involved a large number of well-intentioned people who were attempting to find any loophole available to save Lehman.

And that’s no bullshit.

Posted by Tom at 12:01 AM | Comments (0)

March 15, 2010

The Enronization of Lehman Brothers

The big news in the business world at the end of last week and over the weekend was the publication of the examiner’s report in the Lehman Brothers bankruptcy case.

The big news in the business world at the end of last week and over the weekend was the publication of the examiner’s report in the Lehman Brothers bankruptcy case.

The mainstream media jumped all over the report as a precursor to criminal indictments of former Lehman executives because of allegations in the report (that’s all they are at this point) that Lehman used repo 105 transactions at the end of several quarters to make its balance sheet look more attractive than it really was. Fancy that, executives trying to stem a run on a trust-based business!

Despite the gathering MSM lynch mob, the truth is that the examiner’s report is shaky grounds, at best, for criminal indictments against former Lehman executives. As folks who are experienced in bankruptcy realize – but those who aren’t don’t – an examiner’s report is hardly an objective analysis of a debtor’s affairs. Bankruptcy examiners are highly incentivized to recommend as many legal actions against the debtor’s insiders and counterparties as possible. The fruits of those legal actions inure to the benefit of the bankruptcy debtor’s creditors, which is really the only constituency in most bankruptcy cases that really can effectively challenge an examiner’s compensation. As a result, feather nesting is not an unusual tactic of bankruptcy examiners.

Moreover, examiner’s reports in bankruptcy cases are far from dispositive. I haven’t read the Lehman examiner’s report yet, but I’m skeptical of the MSM’s initial rave reviews. The Enron examiner’s report met with similar early favorable reaction, but it turned out to be chock full of plain factual errors and dubious conclusions based on those errors.

For example, the MSM’s reporting of the examiner’s conclusions regarding the timing of the repo 105 transactions doesn’t make sense to me. As I understand those transactions, they improved Lehman’s balance sheet by increasing its liquidity position at the end of several quarters through converting non-liquid assets to cash. When Lehman repurchased the assets after the date of the financial statement, the balance sheet didn’t change much except for showing less liquidity because the repurchased asset – which went back on the balance sheet after the repurchase - was probably worth more than the liquidity used to repurchase it (I seriously doubt that the sharpies who were dealing with Lehman as it was going down in flames were consenting to using Lehman’s trash assets in the repo deals).

At any rate, Peter Henning and Larry Ribstein have both done a good job of analyzing the main problem facing the Lehman insiders from a criminal standpoint. It is different and potentially more troublesome than the honest services wire fraud theory that was the basis of most Enron-related prosecutions. That is, the Lehman executives are subject to the provisions in the Sarbanes-Oxley legislation enacted after Enron’s bankruptcy that impose criminal liability on executives who falsely certify the (i) accuracy of the financial statements and (ii) absence of deficiencies in internal controls regarding the preparation of the financial statements.

By the way, although Henning’s analysis is quite good, his analogy of the repo 105 transactions to the Nigerian Barge transaction in the Enron-related criminal prosecutions is a stretch. The Nigerian Barge transaction was a relatively small deal in which Enron – about an $80 billion market cap company at the time -- sold its interest in the Nigerian barges to Merrill Lynch to make a $12 million profit at the end of the particular quarter. On the other hand, the examiner alleges that Lehman was using repo 105 transactions to raise $35 - $50 billion of liquidity at the end of several quarters. Big difference.

Also, flying beneath the radar (as usual) is current Treasury Secretary Timothy Geithner and former Treasury Secretary Hank Paulson’s role in all of this. As closely as Geithner (as head of the New York Federal Reserve) and Paulson (as Treasury Secretary) were monitoring Lehman during much of this time, it strains credulity that Geithner and Paulson didn’t have at least some idea of what Lehman was doing to make its balance sheet as attractive as possible. Both Geithner and Paulson were intimately involved in attempting to broker a Bear Stearns-type bailout of Lehman.

So, if Geithner and Paulson knew what was going on, then how on earth is the federal government going to single out Richard Fuld and other former Lehman executives for criminal conduct?

Which brings us to the real lesson of all this – that is, the inherently fragile nature of a trust-based business (related posts here) and the misguided nature of the notion that more governmental regulation will somehow protect investors from the next bust of such a business.

Larry Ribstein has been insightfully pointing out for years that more regulation of those businesses will not prevent the next meltdown, just as the more stringent regulations added under Sarbanes-Oxley after Enron's collapse did not prevent Lehman Brothers from failing. More responsive forms of business ownership certainly are a hedge to the inherent risk of investment in a trust-based business. But also helpful would be better investor understanding of the wisdom of hedging that risk and the importance of short sellers in providing information on troubled companies to the marketplace.

And as for criminal prosecutions? Unless there is evidence beyond a reasonable doubt of a crime, far better to allow the civil justice system allocate responsibility for Lehman’s failure among the multitude of potentially responsible parties. Professor Ribstein nails this point in the final paragraph of his post:

The lesson here is that pursuing high-profile criminal prosecutions in Lehman after the problems with such prosecutions in these situations proved so manifest in Enron would prove that after a decade of hugely costly trials and a massive new law that was supposed to change everything, we still haven't learned a thing about the unsuitability of criminal liability for these kinds of cases.

Finally, Lawrence Kudlow and John Carney have an excellent seven-minute discussion below of the failure of governmental regulation in regard to Lehman:

Posted by Tom at 12:01 AM | Comments (4)

March 14, 2010

50 Impressions in 50 Seconds

Posted by Tom at 12:01 AM | Comments (0)

March 13, 2010

Dragonfly escape

Posted by Tom at 12:01 AM | Comments (0)

March 12, 2010

Challenging the myth of American exceptionalism

Conrad Black’s prison routine allows him time to think and write, which is a good thing in view of the enormous waste that results from his dubious imprisonment.

Conrad Black’s prison routine allows him time to think and write, which is a good thing in view of the enormous waste that results from his dubious imprisonment.

This week Lord Black takes aim at the myth of American exceptionalism promoted in this recent Richard Lowry and Ramesh Ponnurus essay (Walter McDougall has examined the origins of this myth in detail in the first two books of his fine three-part series on American history). In challenging the myth, Lord Black takes dead aim at a common topic on this blog – the overcriminalization of American life:

The wages of this [Cold War] victory have included the stale-dating of the authors’ claim that America “is freer, more individualistic, more democratic, and more open and dynamic than any other nation on earth.” It is more dynamic because of its size, the torpor of Europe and Japan, and the shambles of Russia.

But Americans do not do themselves a favor by not recognizing the terrible erosion of their country’s education, justice, and political systems, the shortcomings of U.S. health care, the collapse of its financial industry, the flight of most of its manufacturing, and the steep and generally unlamented decline of its prestige.

. . . Rampaging and often lawless prosecutors win 95 percent of their cases (compared to 55 percent in Canada), by softening the pursuit of some in exchange for inculpatory perjury against others, in the plea-bargain system. The U.S. has six to fourteen times as many imprisoned people as other advanced prosperous democracies, and they languish in a corrupt carceral system that retains as many people as possible for as long as possible. There are an astounding 47 million Americans with a “record,” and the country glories with unseemly glee in the joys of the death penalty. Due process and the other guarantees of individual rights of the Fifth, Sixth, and Eighth Amendments (such as the grand jury as any sort of assurance against capricious prosecution) scarcely exist in practice.

Most of the Congress is an infestation of paid-for legislators from rotten boroughs, representing the interests that finance their elections and exchanging earmarks with their colleagues like casbah hucksters. . . .

Lord Black can sure still turn a phrase -- “casbah hucksters.” Ha!

Posted by Tom at 12:01 AM | Comments (9)

March 11, 2010

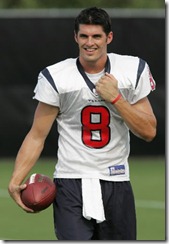

Richard Justice’s confusion about David Carr

So, the Houston Chronicle’s Richard Justice is now writing in the San Francisco Chronicle that it was the fault of former Texans GM Charley Casserly and former head coach Dom Capers that former Texans QB David Carr did not develop into a decent NFL quarterback.

So, the Houston Chronicle’s Richard Justice is now writing in the San Francisco Chronicle that it was the fault of former Texans GM Charley Casserly and former head coach Dom Capers that former Texans QB David Carr did not develop into a decent NFL quarterback.

Of course, Justice extolled the virtues of that same Texans’ management team immediately before their disastrous 2-14 season in Year Four of the franchise (2004):

The Texans have made good use of their honeymoon. They've drafted wisely and spent shrewdly on free agents. They've assembled a front office admired around the NFL. Their players seem to be quality people. [. . .]

The danger for them is that their greatest strength could become their greatest weakness. They've done so many things right and have built such a model operation that it's impossible not to put expectations on a fast track. [. . .]

So far, it's impossible not to be impressed with what the Texans have done. They are run as efficiently as any sports franchise I've ever been around.

Just before the start of training camp, Casserly gathered his employees and thanked them for all their hard work. Then he went down the list of different departments and explained some little thing each had done that made the team - and the organization - better.

That's the kind of thing the people who run sports franchises almost never do, and it left every person who was mentioned proud to be associated with the Texans.[. . .]

Capers believes it's vital to emphasize doing things right because "if you ever slip, you can never get it back."

So far, the Texans haven't slipped in any significant way.

In fact, look at what Justice was saying about the Casserly-Capers-Carr regime even after it had put up a horrid 1-8 record through nine games of the 2004 season:

The Texans are respectable. They're coming close. They've got four 2-7 teams left on their schedule. They almost won in Jacksonville, and they made a run at the Indianapolis Colts before losing 31-17 Sunday. [. . .]

The Texans are a better offensive team since [offensive coordinator Joe] Pendry took over [for the fired Chris Palmer]. David Carr looks like he's on his way to becoming a first-rate quarterback. He's quicker and more accurate in his throws, less likely to take a sack.

But then a couple of months later, after Carr and the Texans had cemented a perfectly awful 2-14 season, Justice had changed his tune to something similar to the one he sings now:

What we'll never know is what would have happened if Carr had gotten with an organization that knew what it was doing. The Texans never protected him or coached him, never put enough talent around him. Shame on you, Charley Casserly. Shame on you, too, Bob McNair. Maybe you guys were wrong about what David Carr could have been, but you never gave him a chance to find out.

Uh, Richard. Five seasons is long enough. Yes, the Texans’ offensive line wasn’t all that good during that span. But Carr wasn’t very good, either, and that didn’t help the offensive line’s performance.

The bottom line is that David Carr was a poor NFL quarterback in Houston. Nothing that he has done with two other teams (with decent offensive lines) since his time here has changed that evaluation. The Texans made a big mistake in selecting him as the team’s first draft choice.

It really is that simple, Richard.

If you are interested in really first-rate analysis of the Texans, then check out local bloggers such as Stepanie Stradley, Lance Zerlein and Alan Burge. Their work beats the Chron sportswriters product hands down.

Posted by Tom at 12:01 AM | Comments (2)

March 10, 2010

Smartphone Etiquette

I’m routinely amazed at how oblivious some people are regarding their rude cell phone manners. So, the 5Across video conversation below on smartphone etiquette interested me.

I’m routinely amazed at how oblivious some people are regarding their rude cell phone manners. So, the 5Across video conversation below on smartphone etiquette interested me.

However, what starts as a discussion about smartphone etiquette turns into a more engaging conversation on the various ways in which different people are processing information in their daily interactions with friends and co-workers.

Proper etiquette is pretty simple. But the way in which people of different social and work groups communicate with each other is not. Watch this fascinating discussion and discover why.

Posted by Tom at 12:01 AM | Comments (1)

March 9, 2010

The National Enquirer one ups the MSM

The Washington Post’s Paul Farhi makes the interesting point in this American Journalism Review op-ed that the biggest scandal in regard to the Tiger Woods affair may be that the National Enquirer tabloid newspaper did a better job of following proper journalistic procedures in breaking the scandal than much of the mainstream media did in follow-up reporting on it:

The Washington Post’s Paul Farhi makes the interesting point in this American Journalism Review op-ed that the biggest scandal in regard to the Tiger Woods affair may be that the National Enquirer tabloid newspaper did a better job of following proper journalistic procedures in breaking the scandal than much of the mainstream media did in follow-up reporting on it:

[National Enquirer Editor] Barry Levine finds himself surprised, appalled and somewhat amused by the way much of the mainstream media handled the Woods scandal. The Enquirer's original story, he notes, took months of reporting. It involved many hours of interviews, polygraph tests, stakeouts, document dives and travel. It was checked and re-checked.

But many members of the MSM, he notes, exercised no such care in reporting subsequent aspects of the story. "It would have taken us a couple of years to properly investigate each of these women's claims as thoroughly as we did the first" woman's, Levine says. "The stories were all over the place. There was just some outrageous coverage."

That's right. The editor of the National Enquirer doesn't think much of the way the "respectable" media covered Tiger Woods. Anyone paying close attention would concur that he has a point. It might be that the biggest scandal to come out of the Woods affair wasn't the one about a golfer. It was the one about the news media.

Meanwhile, The New York Times – that paragon of the mainstream media – is currently taking it on the chin around the blogosphere because one of its leading business reporters essentially doesn’t know what she is talking about in this article from over the weekend.

The blogosphere exposed the vacuous nature of how much of the mainstream media addressed complex issues. Now the tabloids are doing a better quality of reporting than many MSM publications on certain major stories. Will the mainstream media have any credibility or meaningful stature left when the reformation of how we process information is complete?

Posted by Tom at 12:01 AM | Comments (0)

March 8, 2010

Making good on Baylor Med’s bad bet

The Chronicle’s Todd Ackerman and Loren Steffy did a good job in this weekend article of chronicling the series of bad bets that Baylor College of Medicine’s Board of Trustee’s made in the wake of the school’s unfortunate 2004 divorce from The Methodist Hospital. Baylor Med’s travails have been a regular topic on this blog, most recently here.

The Chronicle’s Todd Ackerman and Loren Steffy did a good job in this weekend article of chronicling the series of bad bets that Baylor College of Medicine’s Board of Trustee’s made in the wake of the school’s unfortunate 2004 divorce from The Methodist Hospital. Baylor Med’s travails have been a regular topic on this blog, most recently here.

The elephant in the parlor of Baylor' Med’s financial problems is the $600 million in bond debt that Baylor Med incurred in connection with its currently mothballed hospital project. Indeed, the difference between the total bond debt and the value of the underlying collateral would gobble up a large chunk of Baylor’s endowment, which is currently a tad under a billion dollars. That was enough to scare off Rice University, although I question whether that was the right long-term decision for Rice.

So, the future is bit cloudy for Baylor. But what I’m wondering is whether there is a local partnership that could bail Baylor out of most of current problems while providing an essential benefit for the Houston community?

The last time I look into the issue, estimates in the Houston metro area has one of the largest percentages of uninsured residents in the U.S. (over 30% versus a national average of about 16%). The Harris County Hospital District ultimately ends up with the issues involved with financing indigent care as well as ensuring that adequate medical facilities exist for local citizens.

Given the HCHD’s projected need for facilities to keep up with the growth of the Houston area, it makes sense for the HCHD to engage Baylor in discussions over a partnership in which HCHD would make an investment in the hospital in return for Baylor’s agreement to staff the institution as its primary teaching facility.

Baylor and the HCHD already work closely in connection with the staffing of the Ben Taub Hospital trauma unit in the Texas Medical Center. A pure teaching hospital for Baylor would provide a quasi-public, low-cost alternative to the Med Center’s impressive but expensive array of private hospitals.

Sure, the details would have to be worked out, such as management of the facility. But doesn’t such an investment by the county make sense, particularly when compared to ones such as this?

Posted by Tom at 12:01 AM | Comments (2)