Getting Trade Right

The domestic aluminum industry is growing – creating American jobs and committing or investing more than $2 billion since 2013 to expand U.S. manufacturing. But subsidized production in China, which is leading to unfair and illegal trade practices, threatens the industry’s continued health.

The domestic aluminum industry is growing – creating American jobs and committing or investing more than $2 billion since 2013 to expand U.S. manufacturing. But subsidized production in China, which is leading to unfair and illegal trade practices, threatens the industry’s continued health.

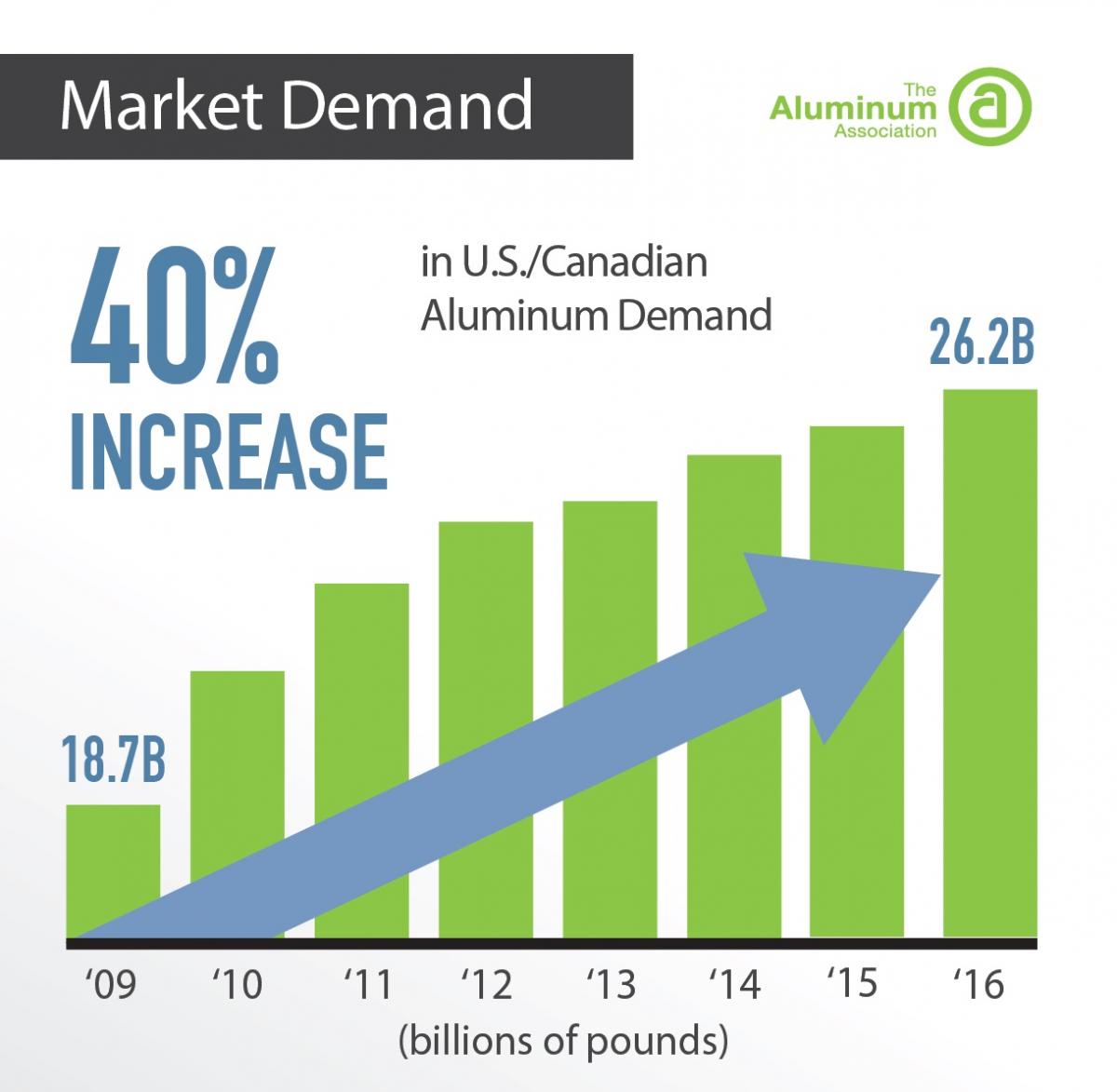

Demand for lightweight, strong, recyclable aluminum continues to rise -- up 40 percent since 2009 and approaching record-setting shipments set in the mid-2000s.

And jobs supported by the U.S. industry are growing -- up 3 percent since 2013 -- while aluminum’s impact on the economy is up 15 percent – this during a time when many commodities industries are struggling.

Why?

Because customers are turning to engineered aluminum solutions to make good products great and great products even better – from more fuel efficient vehicles to sustainable packaging to green buildings. And more growth is on the horizon – 2015 saw more shipments to the transportation market than at any time in the North American industry’s 125-year history.

And yet much of this future growth potential is threatened for one key reason – the persistent and dramatic overcapacity of aluminum in China which is distorting the market and hurting the entire value chain.

And yet much of this future growth potential is threatened for one key reason – the persistent and dramatic overcapacity of aluminum in China which is distorting the market and hurting the entire value chain.

The Trouble with Overcapacity

Over the past decade, Chinese aluminum production has grown at an alarming rate. In 2000, China produced about 11 percent of the world’s primary aluminum – today, it produces more than half. For many years, China absorbed nearly all of this metal domestically but as the economy softened and demand declined, producers did not respond to market signals.

Artificial incentives, subsidies and central planning by the Chinese government have driven much of this activity. And this behavior led to China building production facilities even when doing so made little economic or environmental sense.

What’s more, coal-reliant Chinese aluminum is the most carbon-intensive in the world. If Chinese smelters were a standalone country, they would be the 16th highest contributor to global carbon emissions in the world. This during a time when carbon emissions from North American primary aluminum production have declined nearly 40 percent.

This oversupply, paired with Chinese export tax policy, is creating perverse incentives for producers to engage in a number of questionable and possibly illegal trade activities.

All of this is driving a dramatic increase of imported Chinese aluminum into the United States.

According to Aluminum Association data, U.S. imports of semi-fabricated aluminum products from China grew 183 percent between 2012 through 2015 before leveling off last year.

While Chinese primary aluminum production has continued to grow, U.S. producers are going out of business. Eight U.S. based smelters have either closed or curtailed since 2014 meaning only 2 smelters remain fully operational in the United States today – the lowest level of production since just after World War II. And while overall employment in the U.S. aluminum business is up, employment in the upstream segment has dropped dramatically – from more than 12,000 primary production and alumina refining jobs in 2013 to around 5,000 today – a near 60 percent drop in 3 short years.

And the problem of overcapacity is hurting segments further downstream as well.

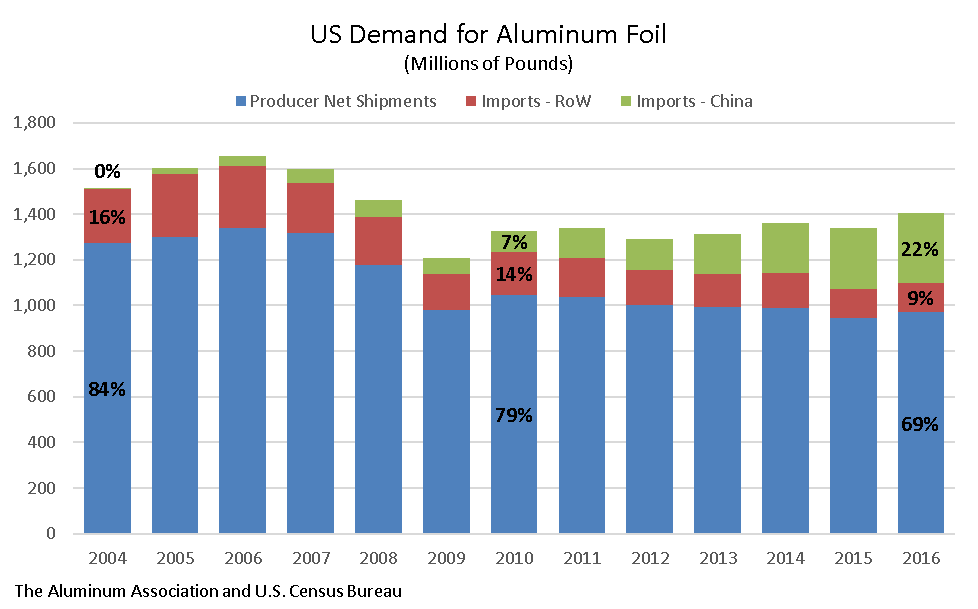

Taking Action on Trade Enforcement

In March of 2017, the Aluminum Association’s Trade Enforcement Working Group filed anti-dumping and countervailing duty (AD/CVD) petitions against the import of aluminum foil products from China – the first such action in the association’s near 85-year history. Twelve years ago, U.S. production accounted for about 84 percent of all domestic aluminum foil demand and today that has dropped to 69 percent. At the same time, Chinese imports grew from essentially 0 percent of the total U.S. aluminum foil market in 2004 to 22 percent of the market today.

U.S. aluminum foil producers generate around $6.8 billion in total economic activity – and support more than 20,000 direct, indirect and induced American jobs. However, that contribution to the economy is at risk thanks to subsidized and dumped product coming from China.

What Else Can We Do About It?

While trade enforcement is one avenue for relief, much more must be done to ensure a level playing field for domestic producers. The Aluminum Association and its members are calling for a negotiated, government-to-government agreement to address the overcapacity issue and the unfair trade practices that have resulted. In April 2017, the White House announced the initiation of a Section 232 investigation into the national security implications of imported aluminum. The industry testified at the Department of Commerce with its view on the best possible outcome for the investigation which you can see here and below. For the Aluminum Association’s full action plan for the U.S. government click here.

Specific calls to actions include:

- End Subsidies and Other Market-Distorting Behavior: The Chinese national government should pursue policies that minimize subsidies, lending and other incentives that artificially prop up aluminum production. The government should also allow inefficient and antiquated facilities to close. The industry in China today is heavily subsidized. For example, the Commerce Department identified 26 separate Chinese government subsidy programs in the foil market as part of the association’s AD/CVD case.

- Enforce U.S. Trade Laws: Ensure that global trade rules and laws are applied and enforced. Aluminum foil is one example of a product segment where subsidies and dumping are distorting the market and creating an unlevel playing field but subsidies exist across the supply chain.

- Crack Down on Misclassification and Transshipment: There’s growing evidence that some Chinese producers are deliberately misclassifying aluminum or shipping the metal through third-party countries to avoid relevant trade duties, unconstrained by government enforcement. China’s current tax policies provide a significant stimulus for this type of behavior and should be re-examined. This illegal behavior distorts the market and violates Chinese and U.S. law.

- Maintain Non-Market Economy Status for China: The aluminum industry, along with the steel, textile, chemical and other industries have formed a coalition – Manufacturers for Trade Enforcement – opposing China’s call for treatment as a market economy under WTO rules. China has not proven that it operates as a market economy. Granting market economy status prematurely would remove a key tool for industries seeking government relief from unfair trade practices.

- Increase Market Transparency: China should work to be more transparent, providing credible, real-time data on aluminum production including shipments and emissions. Specifically, China should disclose information about state-owned enterprises (SOEs) operating in the aluminum industry.We were pleased by the results of the US International Trade Commission's (USITC) Section 332 investigation into the competitive conditions impacting the U.S. aluminum industry. The USITC report confirmed that oversupply is harming global aluminum producers and that China’s capacity growth supplying the world market has far exceeded all other countries. Chinese government intervention in the form of programs and subsidized loans and electricity has played a significant role in China’s aluminum expansion. According to the USITC, Chinese domestic support policies have had the effect of increasing wrought aluminum production and exports by an estimated 13 percent and 80 percent, respectively.

- Hold China to Commitments on Greenhouse Gas Reduction: In addition to capping coal consumption as part of a comprehensive greenhouse gas emissions reduction plan with the U.S., China should set a specific goal to limit and reduce CO2 emissions from aluminum production. This will limit pollution in China while leading to an overall reduction in global greenhouse gas emissions.

A Free, Fair & Competitive Global Industry

The aluminum industry will continue to pursue these initiatives through a variety of bilateral and multilateral channels.

The aluminum industry will continue to pursue these initiatives through a variety of bilateral and multilateral channels.

Domestic aluminum producers are among the best in the world and can compete in a marketplace that is free and fair. There is strong global demand for the metal and all aluminum producers and consumers should be able to benefit from this growth. We remain committed as an association and industry to working toward a sustainable global aluminum market.