-

May 1, 2015

3:49 PM ETShares of cloud computing security technology vendor FireEye (FEYE) are up $2.05, or almost 5%, at $43.35, after the company yesterday afternoon beat Q1 expectations, forecast this quarter above consensus, and raised its full-year outlook.

Estimates are rising, and some price targets are rising here and there today. While both bull and bear are impressed with the company’s sales performance, the bears grumble about the continued losses and lack of improvement on the cash flow statement.

Bullish!

Andrew Nowinski, Piper Jaffray: Reiterates an Overweight rating, and raises his target to $50 from $45. “We believe FireEye is one of the most innovative companies within the security market and with an expanding portfolio of products, now has many more routes-to-market. This should enable the company to continue gaining market share and to deliver 40%+ revenue growth for the foreseeable future [...] Mandiant now has 300 consultants located in 18 countries and is running at full capacity in North America. A common question we hear is whether Mandiant is actually generating follow-on product revenue. Management stated that the company had a 90%+ attach rate of products and subscriptions in Q1, following a Mandiant engagement.” Nowinski riased his 2015 revenue estimate to $627 million from $615 million, while trimming his net-loss-per-share estimate to $1.84 from $1.92.

Daniel Ives, FBR & Co.: Reiterates an Outperform rating, and a $53 price target. “It appears DeWalt & Co. remain on track in light of the company’s ongoing evolving business model (e.g., transition to subscription software) and massive investments for growth. To this point, we believe FireEye is benefiting from an increasing number of high profile breaches, large deal sizes, increased penetration at new/existing customers, and solid cross-sell/upsell opportunities with enterprises across the globe, while the company expands its product/geographic footprint, which will continue to add tailwinds, in our opinion, over the coming quarters/years.” Ives raised his 2015 revenue estimates to $626 million from $614.8 million, while projecting a deeper $1.85-per-share net loss versus $1.80 previously.

Shebly Seyrafi, FBN Securities: Reiterates an Outperform rating, and raises his price target to $55 from $50. “We are impressed by the company’s strong operating margin improvement (-95% a year ago vs. -57% today) as opex grew by only 32% Y/Y. FEYE continues to have a unique position in the security marketplace (it claims that it discovers more zero-day attacks than all other security vendors combined). We are impressed by the company’s ability to sell multiple products to its customers. For example, in FQ1, attach rates of email and FireEye as a Service were quite strong. FEYE’s technologies are now out transitioning out of the early adopter phase, sales cycles have shortened with less or no proof of value (POV) involved.” Seyrafi raises his revenue forecast for this year to $634 million from $622 million, while trimming his loss-per-share estimate to $1.83 from $1.85.

Jonathan Ho, William Blair: Reiterates an Outperform rating. “We believe that the company’s strong execution has helped justify the investments made and willingness to sacrifice near-term profitability and cash flow for long-term market share gains and sustained growth. We continue to view this approach as the correct strategy and believe that the company can succeed. Our main concern remains that competition will close the gap with the company’s core technology and, over the long term, that next-generation detection ultimately becomes a feature set in next-generation firewall solutions.” Ho raised his 2015 revenue estimate to $628.8 million from a prior $615.9 million, while trimming his loss estimate to $1.79 from $1.87.

Bearish!

Erik Suppiger, JMP Securities: Reiterates a Market Perform rating. “We believe the results of the quarter demonstrate that FireEye continues to have robust momentum, but the company’s upside is not translating into significant earnings upside as FireEye continues to aggressively reinvest in operations. FEYE traded up ~3% in response to the results, and with the stock trading at an EV of ~8x our CY16 revenues, we feel the shares are fairly valued [...] Given the company is already spending generously on operating expenses in general and Sales & Marketing expenses in particular (approximately 75% of revenues), we feel management should convert billings upside into improved cash flows.”

Walter Pritchard, Citigroup: Reiterates a Neutral rating, and a $36 price target. “After a rocky 2014 FEYE has put up two clean quarters. Top-line guidance looks conservative and losses are moving in the right direction. The biggest question in our view at these levels is that FEYE is likely the most exposed of our security coverage to marginal breach spending that arguably is well elevated. At the same time, lack of FCF-based valuation through FY18 keeps stock trading on revenue a tenuous position.”

Hendi Susanto, Gabelli & Co.: Reiterates a Hold rating. “We believe FireEye can continue to execute its fast growth trajectory. FireEye-as-a-Service is a smart strategy as it offers stickiness, higher attach rate, cross-selling land-and-expand sales opportunities, and high value security intelligence and experts in consumers’ hands. FireEye’s progress toward its profitability remains of great importance. FireEye is targeting break-even operating cash flow in two-four years and operating margin target of 20-25% in the four-six years from its initial public offering in September 2013. Sales growth, operating margin leverage, and billings growth are key variables to help the company achieve those goals.”

Michael Turits, Raymond James: Reiterates a Market Perform rating. ” Large deals and FaaS were highlighted as well as an HX implementation of >100,000 endpoints. FireEye has built the dominant franchise in APT defense and continues to take advantage of a strong security spend environment. While we expect continued strong near-term growth, we believe FireEye faces a range of risks including 1) uncertain TAM, 2) increasing competition in its core “APT” market, and s) steep CFFO and EBIT losses. We see FEYE as fairly valued at 12.2x 2015E revenues, a 1-point premium to our >30% growth software mean of 11.0x.” Turits raises his 2015 revenue estimate to $627 million from a prior $617 million, and trims his loss-per-share estimate to $1.83 from $1.85.

Rob Owens, Pacific Crest Securities: While FireEye continues to see clear demand momentum, this is coming at a cost. Despite a very strong collections quarter, FireEye lost a significant amount of operating cash flow, resulting in a miss to both operating and FCF expectations. Further, guidance for the year calls for total billings of $830 million at the midpoint and a loss of over $70 million in operating cash flow at the midpoint. Given the current trajectory of the business and incremental cash flow margin forecasted for 2015, FireEye will need to achieve a $1.5 billion billings run-rate prior to generating positive FCF, a roughly two-year undertaking at the current billings trajectory.” Owens raises his fiscal 2015 revenue estimate to $632 million from $620 million, while trimming his loss estimate to $1.80 per share from $1.85.

-

May 1, 2015

10:05 AM ETAmong the bright spots in yesterday’s earnings reports — which included some doozies such as LinkedIn’s (LNKD) disappointment — was wireless chip vendor Skyworks Solutions (SWKS), whose shares are rising $3.33, or 3.6%, at $95.58, after the company yesterday beat fiscal Q2 results and forecast this quarter higher as well.

The performance by one of Apple’s (AAPL) key suppliers — Skyworks’s power amplifier is used in the iPhone 6 — has also given a lift to Apple stock, which is up $1.10, or 0.9%, at $126.25, bucking a negative note this morning from UBS regarding Apple Watch.

Skyworks is getting a lift, too, from confirmation it is in another big flagship phone, the Samsung Electronics’s (005930KS) “Galaxy S6.”

There are no ratings changes on Skyworks, that I can see, but there are some price-target increases here and there, and generally rising estimates.

John Vinh, Pacific Crest Securities: Reiterates an Overweight rating, and a $110 price target. ” SWKS confirmed that its SkyOne Ultra front-end module has been designed into Samsung’s GS6. We believe the company’s content increased by $1 in the GS6 vs. the GS5. In conjunction with increased content on 4G smartphones, we believe this helped more than offset weakness in the China smartphone market, which was down in CQ1. SWKS still sees a strong ramp of 4G smartphones in China and estimates units growing from 100 million in 2014 to the range of 225 million to 250 million in 2015.” Vinh raises his 2015 estimates to $3.25 billion in revenue and $5.15 in EPS from a prior $3.2 billion and $4.92.

Steven Smigle, Raymond James: Reiterates a Strong Buy rating, and a $117 price target. “kyworks has had some great design wins this quarter including their SkyOne Ultra platform in the Galaxy S6 as well as the SkyOne Mini in various Chinese handset OEMs. Skyworks expects for there to be reasonable growth in Chinese handsets going into the C2Q and C3Q. We are very encouraged by this and it is in-line with our expectations for a rebound in Chinese handsets for the second half. Total sales for filters sound more bullish compared to last quarter with management believing they will exceed their goal of selling 1 billion TC-SAW filters in 2015. Content gains on the latest Galaxy S6 are playing a part in the strength, and we estimate that total content for the S6 is ~$3.50-$4.00 depending on the SKU. The Broad Markets segment also sounds positive with new design wins in various automotive and WiFi connectivity solutions. Skyworks has been making great strides to diversity both within their mobile business as well as outside of mobile. We think 2015 will be another strong year for Skyworks as smartphone designs continue to increase in complexity and as LTE grows in countries such as China.” Smigle raises his 2015 revenue estimate to $3.24 billion from $3.22 billion, though he trimmed his EPS estimate to $4.06 from $4.22.

Craig Ellis, B. Riley & Co.: Reiterates a Buy rating, and raises his price target to $120 from $117. ” Despite what we believe will be a material increase to Street estimates, we think fundamentals will continue to go under-estimated. Specifically, new integrated products such as diversity receive modules are poised to compliment the now-ramping SkyOne Ultra, Panasonic JV ops integration and optimization remains in early-innings, and the ability to price for value gets steadily better as the portfolio increasingly migrates to Integrated or Broad Market products which are now 69.0% of sales [...] We’ve been asserting a range of growth vectors – tier-1 handset content gain, emerging country 2G->3G->4G content gain, integrated system uptake, vertical markets drivers, and IoT connectivity are combining to create differentiated yy sales growth. Strong and diversified growth in a challenging environment further bolsters this view. We model 40.8%/10.3% yy growth in F15/16 despite adding 2H15 conservatism, and while regarding the former a fair bogey see material upside potential to the latter given the view SWKS is a share gainer in a TAM growing 15-20%. Every 500 bps in annual sales impacts GM by $0.31.”

Cody Acree, Ascendiant Capital: Reiterates a Buy rating, and raises his price target to $114 from $92. “Even with March generally being a seasonally soft quarter and almost the entire market concerned about an inventory correction in Chinese handsets, SWKS once again turned in another solid beat and raise, driven by revenue upside, product & market diversity, and attractive margins. With China market concerns causing most all supply chain stocks to be weaker recently, we believe SWKS’s strong results offer an attractive entry point. We expect revenue growth and gross margin expansion through the remainder of the year and for investor sentiment to improve with a return of local Chinese handset growth in the current quarter [...] We’re highly encouraged by Skyworks ability to increasingly leverage its cellular strength into a widening variety of new applications, including automotive, medical, industrial, and broadly throughout the Internet of Things application base.” Acree raised his 2015 estimates to $3.22 billion and $5.08 from a prior $3.15 billion and $4.80.

-

May 1, 2015

9:37 AM ETShares of social networking property and enterprise software maker LinkedIn (LNKD) are down $47.40, or almost 19%, at $204.67, in early trading, recovering from a 27% slide last night, after the company slightly beat Q1 expectations, but forecast this quarter’s, and the full year’s, results below consensus.

There were multiple sources for the outlook’s shortfall, including some sales “execution” issues, the company said; the impact of the rising U.S. dollar; and the integration of startup Lynda.com, which the company is in the process of acquiring; and a shortfall in display ads.

During a conference call with analysts following the report, CEO Jeff Weiner boasted of the ways the company had “made meaningful progress against our multi-year strategic roadmap,” including ramping up operations in China, introducing an Arabic-language version of the company’s Web property, and partnering with Starbucks (SBUX) to offer free college educations to the drink-maker’s employees.

CFO Steve Sordello described a transition in the sales process that affected results:

We showed strong growth in new customers, reflecting particular strength in North America and with SMBs. Overall, we ended the quarter with nearly 35,000 accounts, growth of 35% year-over-year. Existing customers increased spending per account but a larger than normal sales rep transition led to increase in churn and lower upsales during the quarter. We typically transition a portion of accounts early in the year as we onboard new reps. This trend was especially pronounced in Q1 as we resegmented the customer base in order to drive deeper relationships. As a result, we increased the number of account transitions across the global sales force by over 50% versus last year. While this was a planned adjustment we underestimated the impact from this large initiative with respect to short-term churn and 2015 revenue more broadly.

There are lots of price target cuts today, and estimate cuts, but as of yet, no ratings cuts, and there are several who have stepped up to defend the stock.

Rob Peck, SunTrust Robinson Humphrey: Reiterates a Buy rating, and cuts his price target to $250 from $275. “[Marketing Solutions] had two impacts: 1) the display business is succumbing to the secular headwinds faced by the industry, seeing double digit price declines in the Q; and 2) transition to a new product suite (incorporating Bizo) in the quarter. In both cases, the actual transition of the corporate structure and internal training has been completed and those teams are in market. However, the education of the marketplace and execution across the sales cycle is ongoing and a driver of the conservative guidance [...] raffic and page views all decelerated… While Sponsored Updates was strong, Display was weak particularly in Europe on shift to programmatic.”

Blake Harper, Wunderlich Securities: Reiterates a Buy rating, and cuts his price target to $260 from $300. “The company saw its display ad business, especially in Europe, decline due to a shift to programmatic buying, but we remain bullish on the company’s potential to become a differentiated B2B content marketing platform [...] e are lowering our FY15 and FY16 estimates (Figure 2) but would expect the company to be able to generate upside surprise following these transitions. The company remains in heavy investment mode but, given its enterprise opportunity and unique assets, we believe this will be worthwhile. Key metrics such as number of members, mobile visitors, and corporate talent solution customers were all in line with expectations (Figure 3), which reaffirms the value of the platform.”

Victor Anthony, Axiom: Reiterates a Buy rating, and cuts his price target to $230 from $300. “Weakness in display revenues … is our only fundamental concern, one that appears to be industry-wide, and is likely a challenge to reverse. LNKD does have a potential offset in a performance-based ad unit, but until it becomes big enough, display will weigh on results. While the guidance was surprising, it has not shaken our belief in the strength of LNKD’s business model […] For Investors who missed the last leg up in the stock, the pullback creates and opportunity to revisit the story.”

Michael Graham, Canaccord Genuity: Reiterates a Buy rating, and cuts his price target to $250 from $300. “Most factors impacting revenue appear temporary (FX, marketing solutions product transition, Talent Solutions sales force shuffle, lynda.com), while a display revenue headwind seems more secular. While the stock’s expensive valuation leaves no room for speed bumps, we remain convinced of LinkedIn’s long-term opportunity. We are encouraged by rapid growth in Sales Solutions, and believe any material weakness in the stock will likely provide a good long-term entry point.”

Arvind Bhatia, Sterne Agee: Reiterates a Neutral rating. “Slightly more than half of the lowered EBITDA guidance resulted from the acquisition of Lynda.com, another 30% due to worse-than-expected FX headwinds and ~20% of the reduction related to weaker-than-expected core business. Within the core business, about two-thirds of the reduction related to weakness in the company’s display advertising business (-10% y/y) while the other one-third was due to sales rep transition within the Talent Solutions business.”

-

May 1, 2015

9:10 AM ETShares of Apple (AAPL) are up 67 cents, or half a percent, at $125.82, in early trading, despite a cautious note this morning from Steve Milunovich of UBS, who writes that his perusal of online mentions suggests people are not very interested in the recently released Apple Watch.

Milunovich reiterates a Buy rating on Apple shares, and a $150 price target, but cuts his estimate for the number of units of the device in 2016 to 31 million from 40 million.

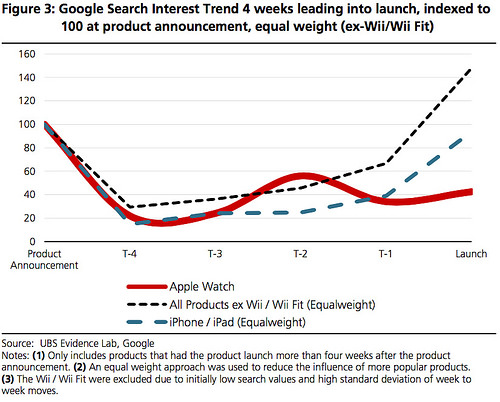

Writes Milunovich, “Search interest has deviated lower relative to an index of 30 consumer electronics introductions and the first iPad and iPhone releases—the week of launch, the Watch is about 20% of iPad and iPhone interest.”

Moreover, “We now think about 7% rather than 10% of the expected iPhone 5/6 average installed base of 430mn in F16E is likely to buy a Watch.”

Still, Milunovich insists it is “just the first inning,” writing that “We are long-term bullish on the Watch as the interface to the Internet of Things; the wrist is a natural place to put Apple technology.”

Milunovich’s evidence comes from an index of search requests:

We created an index of search interest for 30 consumer electronics launches in the US as well as for the first iPhone and iPad (Figure 3). The initial value is based on search interest at the time the product was announced. The Apple Watch had been performing in line with the index until the T-2 period, when pre-orders became available. Since then, search interest has deviated lower against both an index of 30 consumer electronics introductions and the release of the iPhone and iPad.

Milunovich has a raft of tables and charts, here’s just one (click to see the graphic larger):

Milunovich lays the blame at Apple’s feet for having “botched” the roll-out of the watch, discouraging early buyers:

Apple has somewhat botched the Watch introduction. First “early” in the year was defined to include April. Then supply issues pushed back availability for most early buyers. The buzz has been reduced by requiring appointments and by the inability for now to take Watches home from Apple stores. However, Apple is right to go slowly as the Watch represents a new category. Word of mouth will be important, so training users is needed. We are long-term bullish on the Watch as the interface to the Internet of Things; the wrist is a natural place to put Apple technology.Press reports have indicated supply issues stemming from worker shortages at the assemblers, poor manufacturing yields relating to the display, and most recently defect issues with the Taptic Engine. These aren’t the first problems Apple has had to face during a new product roll-out, recalling poor in-cell display yields for the iPhone 5 and Antennagate with the iPhone 4. Still, given the advanced notice of the first media event in September along with the follow-up event in March, Apple built interest for which it has not been able to deliver. This ambiguity surrounding the true availability of the Watch might be putting off consumers, reducing any sense of urgency and perhaps lowering initial demand.

-

Apr 30, 2015

5:07 PM ETJDSU Slips: Q4 View Light on Continued Carrier Sluggishness

By Tiernan RayShares of fiber optics component vendor JDSU (JDSU), which is expected to split this year into two separate companies, are down 55 cents, or 4.3%, at $12.11, in late trading, after the company this afternoon reported fiscal Q3 revenue and earnings that missed analysts’ expectations, and forecast this quarter’s results lower as well, citing continued softness in carrier equipment spending.

Revenue in the three months ended in March declined by 1.8%, to $410.7 million, yielding EPS of 12 cents.

Analysts had been modeling $418 million and 9 cents per share.

CEO Tom Waechter noted the company had produced “better-than-expected operating margin and EPS” even though it faced “muted carrier spending that impacted our Network and Service Enablement businesses.”

Waechter said results in optical components for “datacom,” meaning enterprise networks, had been “strong,” with “a record revenue quarter,” and that JDS was encouraged by progress in our next generation service enablement solutions.”

Of the coming split, he said “Lumentum and Viavi Solutions are building momentum and we remain on plan to complete the spin in the third calendar quarter this year.”

For the current quarter, the company sees revenue of $413 million to $433 million, and EPS of 9 cents to 13 cents. That compares to consensus for $444 million and 16 cents a share.

JDSU management will host a conference call with analysts at 5 pm, Eastern time, this evening, and you can catch a webcast of it on the company’s investor relations home page.

-

Apr 30, 2015

4:52 PM ETConstant Contact Plunges 13%: Q1 Rev Misses, Cuts Year View

By Tiernan RayShares of e-mail marketing services provider Constant Contact (CTCT) are down $4.45, or almost 13%, at $30.40, after the company this afternoon reported Q1 revenue that missed analysts’ expectations, and cut its year outlook, citing a failure to execute on its plans.

Revenue in the three months ended in March rose 14.6%, year over year, to $90.4 million, yielding EPS of 22 cents, excluding some costs.

Analysts had been modeling $91.1 million and 19 cents per share.

CEO Gail Goodman said the company was “disappointed with the mixed results for the quarter, as revenue came in below expectations while profitability was better than expected.”

Explained Goodman, “in the quarter we didn’t deliver an acceleration in customer additions as expected, which resulted in missing our revenue goal. Given the current trends, we are adjusting down our revenue plans for the remainder of the fiscal year.”

We are confident in our strategy for an integrated marketing suite for small businesses and organizations. However, it is clear that we need to execute better. We have a framework to deliver sustainable revenue growth of greater than 20 percent, coupled with profit margins greater than 20 percent, and while disappointed by the near term setback, we are confident in our ability to deliver on this goal over time.

The company added 55,000 new “unique customers” on a “gross basis,” the same as the prior-year quarter, it said. That brought total customer count to 645,000, it said.

Average monthly revenue per customer was $47.09, said the company, up from $43.82 a year earlier.

For the current quarter, the company expects revenue of $91.5 million to $92 million, and EPS of 21 cents to 22 cents, excluding some costs. That compares to the consensus for $94.5 million and 23 cents.

For the full year, the company now sees revenue of $371 million to $377 million, and EPS of $1.29 to $1.38. That is down from the company’s prior forecast of $388 million and $1.38 per share.

-

Apr 30, 2015

4:46 PM ETSkyworks Rising: Q2 Beats, Q3 View Tops Consensus

By Tiernan RayShares of wireless chip maker Skyworks Solutions (SWKS) are up $2.65, or almost 3%, at $94.90, after the company this afternoon reported fiscal Q2 revenue comfortably ahead of consensus, and beat on the bottom line, and forecast this quarter’s results higher as well.

Revenue in the three months ended April 3rd rose 58%, year over year, to $762 million, yielding EPS of $1.15, excluding some costs.

Analysts had been modeling $752 million and $1.13 per share.

Gross profit margin in the quarter was 46%, up from 44% a year earlier.

CEO Dave Aldrich said the results “underscore the success of our diversification strategy, as positive momentum across our customer base, end markets and product lines helped to mitigate normal March quarter seasonality.”

Aldrich added that the business “continues to perform at a high level, as we capitalize on a number of powerful global trends driving the proliferation of connectivity in all of its forms; by leveraging our architectural and integration leadership, we continue to enhance our competitive differentiation, expanding profitability and creating greater value for our customers and shareholders.”

For the current quarter, the company sees revenue of $800 million, and EPS of $1.28, excluding some costs. That is above the average estimate on the Street for $781 million and $1.19.

The company expects gross profit in the quarter to rise to 48%.

Skyworks management will host a conference call with analysts at 5 pm, Eastern time, this evening, and you can catch a webcast of it on the company’s investor relations home page.

-

Apr 30, 2015

4:33 PM ETExpedia Up 8%: Q1 Rev Beats Despite Forex Pressure

By Tiernan RayShares of online travel booker Expedia (EXPE) are up $7.27, or almost 8%, at $101.50, after the company this afternoon reported Q1 revenue that topped expectations, though it reported a surprise net loss, saying volume of business helped to offset declines from the rising U.S. dollar.

Revenue in the three months ended in March rose 14.4%, year over year, to $1.37 billion, yielding a net loss per share of 3 cents.

Analysts had been modeling $1.35 billion and a 9-cent-per-share profit.

Expedia said its “room nights,” a metric of the volume of business, rose 32%, year over year, with domestic bookings up 23% and international bookings up 41%.

Hotel revenue rose 14%, the company said, even though revenue per room night fell 14%. The decrease was, again, the effect of foreign exchange, the company said.

The company’s “gross bookings” were up 19%. Expedia said that would have been an increase of 25%, if not for the impact of foreign exchange.

Expedia said its revenue from airline tickets rose 9%, with tickets sold rising in volume by 18%, but revenue per ticket dropping 7%.

Expedia’s Ebitda, on an adjusted basis, was $102 million, down 5% from the prior-year quarter.

Expedia ended the quarter with cash and equivalents of $2.1 billion, and free cash flow was $900 million.

Expedia management will host a conference call with analysts at 4:30 pm, Eastern time, and you can catch a webcast of it on the company’s investor relations home page.

-

Apr 30, 2015

4:21 PM ETFireEye Up 4%: Q1 Rev Beats, Q2 View Beats; Raises Year View

By Tiernan RayShares of cloud computing security vendor FireEye (FEYE) are up $1.35, or 3.3%, at $42.65, after the company this afternoon reported Q1 revenue that topped analysts’ expectations, but a deeper-than-expected net loss per share, forecast this quarter and raised its outlook for the year’s revenue.

Revenue in the three months ended in March rose 69%, year over year, to $125.4 million, yielding a net loss, excluding some costs, of 58 cents per share.

Analysts had been modeling $120.6 million and a 51-cent loss.

The company’s billings rose 53% to $151.6 million. Deferred revenue was up 78% at $378.8 million.

CEO Dave DeWalt called the results “a very strong start to the year” saying momentum continued from Q4.

Company results “exceeded expectations on all financial metrics, leading us to raise our outlook for the remainder of 2015,” he said.

Added DeWalt,

Demand was strong across all product segments, indicating that customers are turning to us for a range of solutions. FireEye is continuing to reach customers on a global scale, with growth balanced across all geographic regions. The company added more than 220 new customers in the first quarter and closed 28 transactions over one million dollars, a record for first quarter, and two times the number of seven-figure deals in the first quarter of 2014.

For the current quarter, the company sees revenue in a range of $140 million to $144 million, and a net loss per share of 47 cents to 50 cents. That compares to the average estimate for $140 million and a 49-cent loss.

Billings are expected in a range of $165 million to $170 million.

For the full year, the company sees revenue in a range of $615 million to $635 million, and net loss per share $1.75 to $1.85. That is up from a prior forecast for $605 million to $625 million, and above consensus for $620 million and $1.86 in net loss per share.

The company expects billings of $825 million to $835 million, and negative cash flow from operations of $65 million to $80 million.

FireEye management will host a conference call with analysts at 5 pm, Eastern time, this evening, and you can catch a webcast of it on the company’s investor relations home page.

-

Apr 30, 2015

4:09 PM ETLinkedIn Plunges 27%: Q1 Meets, Q2, Year Views Miss

By Tiernan RayShares of social networking and enterprise software purveyor LinkedIn (LNKD) are down $46.48, or almost 18%, at $205.65, after the company announced Q1 results just slightly ahead of analysts’ expectations, and missed with its Q2 and year views.

Revenue in the three months ended in March rose 35%, year over year, to $638 million, yielding EPS of 57 cents, excluding some costs.

Analysts had been modeling $638 million and 57 cents.

CEO Jeff Weiner called the quarter “solid,” citing “steady growth in member engagement” and “strong financial results.”

The company’s “talent solutions” business saw revenue rise 36%, to $396 million.

“Marketing solutions” was up 38%, at $119 million.

The company’s “premium subscriptions” business was up 28%, at $122 million.

For the current quarter, the company sees revenue of $670 million to $675 million, below consensus of $719 million million.

For the full year, the company sees revenue of “approximately $2.9 billion,” which is below the consneuss for $2.988 billion, according to FactSet.

LinkedIn management will host a conference call with analysts at 5 pm, Eastern time, and you can catch a webcast of it on the company’s investor relations home page.

Update: The stock keeps dropping here, down $54.13, or almost 22%, at $198.

Update 2: The stock is now down $62.53, over 25%, at $189.38.

Update 3. Stock is now down $64.63, or almost 26%, at $187.50.

Update 4: Now down $68.13, or 27%, at $184.

- « Previously in Tech Trader Daily

- Next in Tech Trader Daily »

About Tech Trader Daily

-

Tech Trader Daily is a blog on technology investing written by Barron’s veteran Tiernan Ray. The blog provides news, analysis and original reporting on events important to investors in software, hardware, the Internet, telecommunications and related fields. Comments and tips can be sent to: techtraderdaily@barrons.com.