Shai Bernstein: Private Equity Buyouts Improve Operations and Management

Private equity firms often get a bad rap in the popular media — picture Gordon Gekko in the 1980s movie Wall Street and, more recently, negative characterizations during the last presidential election — but new research by Stanford faculty member Shai Bernstein should dispel some of the myths about this class of investments.

“The public debate about private equity often lacks data upon which to base its arguments,” says Bernstein, who is an assistant professor of finance at Stanford Graduate School of Business. “We wanted to take an in-depth look at the operations of these privately held firms, which are, more often than not, hidden from the public eye.”

After a rigorous analysis of private equity (PE) buyouts in the restaurant industry in Florida, which looked at 103 separate deals from 2002 to 2012 and 3,700 restaurant locations, Bernstein and Harvard Business School faculty member Albert Sheen found strong evidence that private equity buyouts actually improved management practices and operations, as well as decreased prices, all with a minimal impact on employment.

While the study focuses on a single industry and geography, Bernstein stipulates that the findings are indicative of the broader value created by PE buyouts. As he explains, the restaurant industry has much in common with other sectors that attract private equity firms — they have tangible assets, relatively simple operations, and predictable cash flows. “We believe we can draw broader conclusions from these deals,” he says, although noting that some caution should be used in making generalizations.

The researchers decided to focus their efforts on restaurants because of the industry’s pervasive practice of dual ownership, in which a parent company directly owns and manages some locations and others are franchised. In general, a parent company has much less control over franchisees than locations that are directly owned. According to Bernstein, this provided a uniquely controlled experiment about the value added by PE firms, allowing the researchers to compare the effect of private equity ownership on direct-owned versus franchised locations.

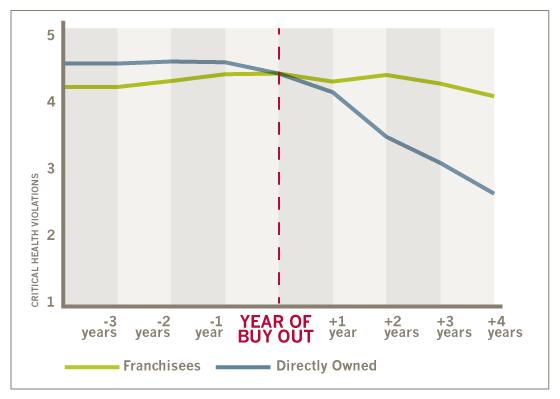

In order to assess the extent of PE influence, Bernstein and Sheen pored through health inspection data for the more than 50,000 restaurants in operation from 2002 to 2012, which gave them a back-stage view of restaurants’ operating practices. Their finding? Restaurants commit fewer critical health violations after being acquired by a PE firm, and this effect increases steadily in the five years after a buyout.

(2002–2012)

“These operational practices matter,” says Bernstein, who explains that critical health violations, such as improperly cooked food and poor hygienic practices, are strongly correlated with poor customer reviews on Yelp.com and the future likelihood of store closure. On the flip side, a reduction in such violations leads to an improvement in store revenue and a reduction in the number of foodborne illnesses.

How did the pair prove that such improvements were the result of PE involvement, rather than an already expected business trajectory? That’s where the comparison between direct-owned versus franchised locations came in. Bernstein and Sheen found that improvements in health practices were concentrated in directly owned restaurants, in which PE firms have the most influence. Interestingly, they also found evidence of spillover effects, as franchisees improved their own practices over time to compete more effectively with their better-managed, direct-owned counterparts.

“These kinds of systemic, operational improvements do not take place by happenstance,” observes Bernstein. “They require coordinated improvements in training, monitoring, and employee incentives — all of which point to the conclusion that private equity ownership improves management practices across the organization.”

Meanwhile, Bernstein says that these improvements in operational practices and food safety do not translate into higher prices for consumers. In fact, the team’s research shows that, compared to average prices for all restaurants, the average menu item is 29 cents cheaper at restaurants in the years after a PE takeover, reflecting a 4.4 percent decline in overall menu prices. Entrees, the most expensive menu item, show the largest and most significant declines.

These price decreases aren’t the result of massive layoffs, either. “The popular press often chides private equity for eliminating jobs for debt service and short-term profits, but we found that the impact on employment is modest,” observes Bernstein. They show that the average restaurant in a chain, both direct owned and franchised, has just one less full-time equivalent employee after a PE buyout.

The research team has found additional evidence that PE involvement leads to a decreased likelihood of restaurant closures. Given that the most prominent reason to close a restaurant is poor financial performance, they surmise that restaurants are more profitable following a PE buyout, although additional research is needed to confirm their hypothesis.

View the Research Paper

The Operational Consequences of Private Equity Buyouts: Evidence from the Restaurant Industry

December 8, 2013