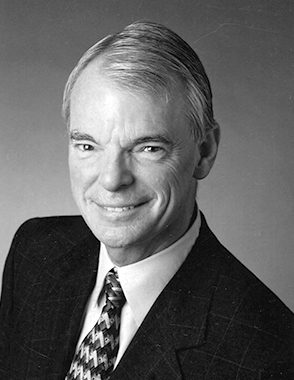

Michael Spence

|

|

|

|

American Academy of Arts and Sciences |

Econometric Society (elected fellow) |

Michael Spence is a senior fellow at the Hoover Institution, a professor of economics at the Stern School at New York University, and the Philip H. Knight Professor Emeritus of Management in the Graduate School of Business at Stanford University.

Spence’s latest publication is The Next Convergence: The Future of Economic Growth in a Multispeed World (2011).

He served as the chairman of the independent Commission on Growth and Development (2006–10).

He was awarded the Nobel Memorial Prize in Economic Sciences in 2001 and the John Bates Clark Medal from the American Economic Association in 1981. He was awarded the David A. Wells Prize for the outstanding doctoral dissertation at Harvard University and the John Kenneth Galbraith Prize for excellence in teaching.

He served as the Philip H. Knight Professor and dean of the Stanford Business School (1990–99). As dean, he oversaw the finances, organization, and educational policies of the school. He taught at Stanford as an associate professor of economics from 1973 to 1975.

He served as a professor of economics and business administration at Harvard University (1975–90). In 1983, he was named chairman of the Economics Department and the George Gund Professor of Economics and Business Administration. Spence also served as the dean of the Faculty of Arts and Sciences at Harvard (1984–90), overseeing Harvard College, the Graduate School of Arts and Sciences, and the Division of Continuing Education.

From 1977 to 1979, he was a member of the Economics Advisory Panel of the National Science Foundation and in 1979 served as a member of the Sloan Foundation Economics Advisory Committee. He has served as a member of the editorial boards of the American Economics Review, Bell Journal of Economics, and Journal of Economic Theory.

Spence is a member of the boards of directors for General Mills and a number of private companies. He was chairman of the National Research Council Board on Science, Technology and Economic Policy (1991–97).

He is a member of the American Economic Association and a fellow of the American Academy of Arts and Sciences and the Econometric Society.