Taxes

President Obama has passed a simpler and fairer tax code that closes the loopholes that benefit wealthy Americans in order to help the struggling American families who need assistance most.

We have to set priorities. If we want a strong middle class, then our tax code must reflect our values.President Obama

President Obama has passed wide-ranging tax relief for working families and small businesses — the drivers of economic growth. But the tax code is still too complicated and full of inefficient loopholes and tax breaks that mostly benefit the wealthy. The President has proposed to simplify our tax code, make it fairer by eliminating some of the largest tax loopholes, and reinvest the savings in measures that will grow the economy and expand opportunity. The President's plan would make paychecks go further in covering the costs of child care, college, and a secure retirement, and would create and improve tax credits that support and reward work.

Tax Cuts for the Middle Class

Under President Obama’s leadership, we have made substantial progress in making the tax code fairer for working families. Under President Obama:

- A typical family making $50,000 a year received tax cuts totaling $3,600 in President Obama’s first term — more if they were putting a child through college.

- The American Opportunity Tax Credit (AOTC) now provides college students with up to $10,000 of tuition tax credits over four years.

- Improvements to the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC), enacted in 2009 and extended twice more under President Obama, are helping 16 million working families make ends meet.

- Bipartisan legislation permanently lowered income tax rates for 98 percent of Americans, while asking the wealthiest households to pay more to help reduce the deficit. Learn more about the American Taxpayer Relief Act of 2012.

As a result, middle-class taxes are at historically low levels, with the typical middle-income family paying lower federal income taxes than in almost any other period in the last 60 years.

Tax Cuts for Small Businesses

President Obama firmly believes that entrepreneurs and small businesses are engines of economic growth, and that their investments and innovation have been at the forefront of our economic recovery. That’s why he and his Administration have focused on strengthening small businesses by signing into law a series of tax cuts for small businesses. These tax cuts have helped small business hire and grow, provide affordable health insurance to employees, and invest in new machinery and equipment. The President also believes we should be doing more to help our small businesses succeed in a changing economy. As part of his framework for Business Tax Reform, the President has proposed additional tax relief, while greatly simplifying tax filing for small businesses, including:

- Expanded and permanent small business expensing to encourage and reward investment. Small businesses can currently expense up to $500,000 of investment, but only temporarily. The President would permanently increase the limit to $1 million, and index it for inflation going forward.

- Dramatically simplified accounting for small businesses to reduce taxpayer burden. As part of business tax reform, the President’s plan would let businesses with gross receipts of less than $25 million — 99.6% of all businesses — dispense with most complicated accounting rules, which can be especially complex and costly for small businesses.

- Further simplifications and tax relief, for example by eliminating capital gains taxes on small business stock; and allowing small businesses to expense up to $20,000 of start-up costs.

A Simpler, Fairer Tax Code That Responsibly Invests in Middle-Class Families

Despite the progress that has been made, middle-class families today still bear too much of the tax burden because of unfair loopholes that are only available to the wealthy and big corporations.

In his 2015 State of the Union Address, the President proposed a plan to simplify our complex tax code for individuals, make it fairer by eliminating some of the biggest loopholes, and use the savings to responsibly pay for the investments we need to help middle-class families get ahead and grow the economy. The President’s plan would help the paychecks of middle-class and working families go further through the following tax cuts and simplifications:

- A new $500 second earner credit to help cover the additional costs faced by families in which both spouses work — benefiting 24 million couples.

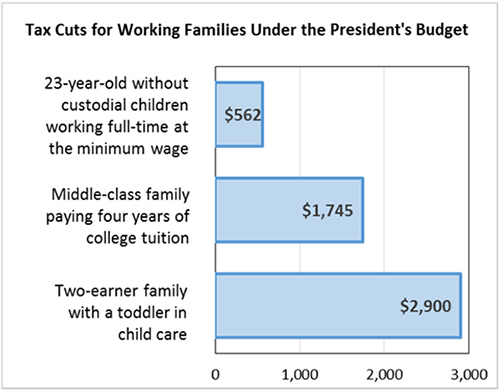

- A simplified and dramatically expanded Child Care Tax Credit that would give a tax cut of up to $3,000 per child for middle-class families with young children. The proposal will complement major new investments in the President’s Budget to improve child care quality, access, and affordability.

- Simplified, consolidated, and expanded education tax benefits, including an expanded American Opportunity Tax Credit that would provide more students up to $2,500 each year over five years (for a total of $12,500) as they work toward a college degree.

- Retirement savings opportunities for 30 million more workers.The President’s retirement tax reform plan gives 30 million additional workers the opportunity to easily save for retirement through their employer.

- An expanded Earned Income Tax Credit for workers without children and permanent extension of the EITC and Child Tax Credit improvements.

The President’s plan is fully paid for by eliminating the biggest tax loophole that lets the wealthiest avoid their fair share of taxes, and by making other reforms to capital gains and financial sector taxation. The President’s plan would:

- Close the trust fund loophole — the single largest capital gains tax loophole — to ensure the wealthiest Americans pay their fair share on inherited assets.

- Raise the top capital gains and dividend rate back to the rate under President Reagan (28 percent).

- Reform financial sector taxation to make it more costly for the biggest financial firms to finance their activities with excessive borrowing.

Investing in America’s Infrastructure and Reforming Our Business Tax System

In addition, the President has put forward a framework for fixing the business tax system on a revenue- neutral basis and using the transition revenue to pay for investments in infrastructure. The President’s proposal would create jobs, spur economic growth, and provide States and localities with the certainty they need to plan for the future. His plan includes a $478 billion, six-year surface transportation reauthorization proposal that is paid for with transition revenue from pro-growth business tax reform. The President’s plan for business tax reform would:

- Close loopholes to stop rewarding companies for keeping profits abroad, while rewarding those that invest in America.

- Use revenue from the transition to a more modern, efficient business tax system to rebuild America’s infrastructure.

- Simplify and cut taxes for small businesses.

Understanding Where Your Tax Dollars Are Spent

In his 2011 State of the Union Address, President Obama promised that, for the first time ever, American taxpayers would be able to go online and see exactly how their federal tax dollars are spent. Just enter a few pieces of information about your taxes, and the taxpayer receipt will give you a breakdown of how your tax dollars are spent on priorities like education, veterans benefits, or health care.

Related Videos

White House Whiteboard Shorts: #RaiseTheWage

White House White Board - American Taxpayer Relief Act of 2012