One of the toughest challenges for founders of a young company is deciding how to split the equity among the founders and early hires, says venture capitalist Peter Ziebelman. This is especially complex when cofounders are inexperienced or have a friendship as well as business partnership. Putting value on each partner’s role can get personal and it is best done not in one late-night session, but more methodically, over a period of time, and with advice, he says.

The good news is that getting through the process unscathed can bode well for how the founders will handle the many difficult decisions that are sure to follow as the company matures.

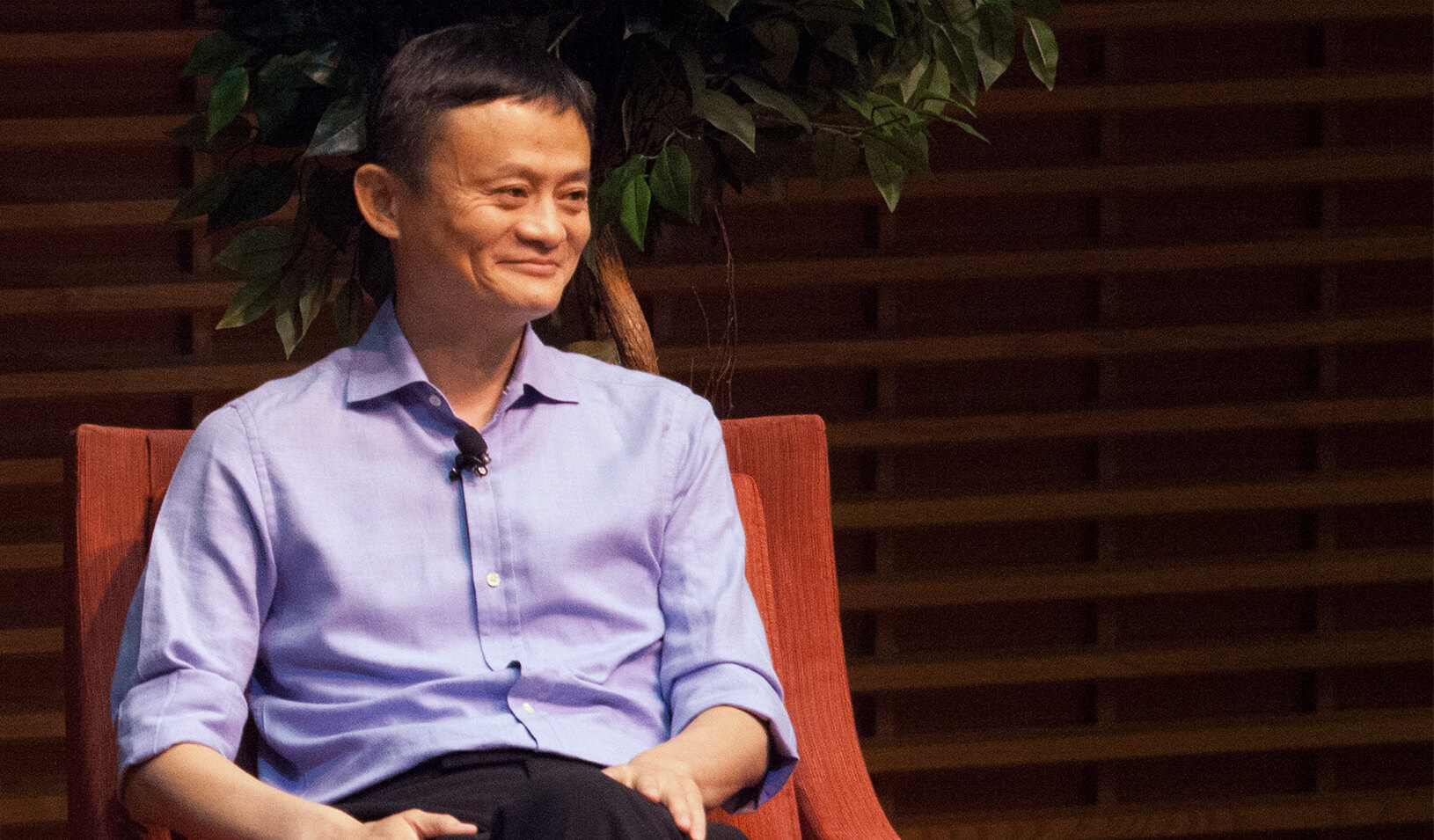

Ziebelman, a lecturer at Stanford GSB who cofounded Palo Alto Venture Partners in Palo Alto, Calif., has served on the board of early-stage companies that eventually became public. He shared his advice for splitting equity during an interview with Insights by Stanford Business following a May 1 forum on campus sponsored by the Center for Entrepreneurial Studies.

Hold Some Shares Back

Founder breakups are relatively common among inexperienced teams, Ziebelman says. They often split over disputes about titles and roles that are intricately linked to equity division. “They thought they were going to be the VP of sales, and it turns out they’re not as good at sales as they thought,” he says. Then, the question comes up of whether they should receive the same equity as a founder who does have VP status.

Another key reason for breakups centers around the amount of time and effort each person puts into the company. “Sometimes there’s lots of energy at the start, but once you hit the first speed bump, then a founder may decide that this isn’t for him or her and just may not put in the same amount of time.”

Since many of these scenarios rise as a company evolves, Ziebelman recommends building in safeguards early on.

“What we counsel is to hold some shares back. Don’t allocate all the shares amongst the founding team,” he says. Let’s say 75% of the company is being divvyed up among three partners. Instead of giving 25% to each person, consider 20% each “and hold 15% for later for what we call course correction,” he advises. Down the road, 15% can go a long way to change and correct an inequity that might happen should one of the founders underperform or excel beyond the others.

If the founders decide to not hold shares for later, they may decide on a split that may be purposely unequal, such as 20-20-35. The founders should consider each position and the value each person will add to company. Unequal splits usually consider a premium for bringing the idea to the start-up, taking a lower salary, and/or taking the CEO or CTO position.

When Is the Right Time?

A common question among entrepreneurs is whether they need to have the equity split determined before they make their pitches to a venture capitalist. “And the quick answer to that is no, you don’t have to have everything figured out,” he says.

But the founders need to provide investors with a good reason for the delay. If the reason is “you just don’t want to face the decision” VCs will see it is a red flag, he says. There are accounting and tax reasons for getting it done early, too, and it can get more difficult as more and more time passes in the life of a company, he says.

An independent board member can help settle disputes, but Ziebelman recommends having the founding team hash out the equity allocations among themselves if possible. “You’re going to have several difficult questions as you build your company, and this is probably just one of them, so it is a good practice run,” he says.

Bring a Method to the Madness

“I think the smartest move we’ve seen is when founders assess each other’s performance and contribution to the company and they do this in a very systematic way,” he says. This may prevent breakups, and it also should be coupled with self-assessments. “Founders are pretty good at assessing their cofounders, but when they can assess themselves with the same rigor, that also helps create a good flow of constructive information.”

Also, a number of accounting and search firms do surveys that discuss and tabulate how much equity is typically allocated for each position, and even how much equity founders have at each stage of funding. “So there is information out there.” For example, CompStudy has collected this information for many years. There is also a book that addresses this subject called The Founder’s Dilemma by Noam Wasserman. They can serve as a guideline that you can customize for your particular company, he says.