See the full lineup of artists and performers.

POLICY SNAPSHOT

America prospers when the middle class is secure, everyone does their fair share, and everyone plays by the same rules.

Progress

-

Prevented an income tax hike for 98 percent of Americans and nearly every small business, saving the typical family from paying about $2,000 more in taxes starting in 2013. Read about: keeping taxes low for middle-class familiesRead about keeping taxes low for middle-class families: http://wh.gov/UNjo

-

Provided tax relief to 95 percent of working families through the Recovery Act.

Read about: the Making Work Pay Tax CreditRead about the Making Work Pay Tax Credit: http://wh.gov/3RJ

-

Created and extended a tax credit worth $10,000 over four years that helps 9 million families cover the cost of college.

Read about: the American Opportunity Tax CreditRead about the American Opportunity Tax Credit: http://wh.gov/HaZk

-

Extended a tax credit that helps workers keep more of what they earn by continuing an expansion of the credit for married couples and larger families.

Read about: the Earned Income Tax CreditRead about the Earned Income Tax Credit: http://wh.gov/jmb

-

Extended expanded tax relief for 35 million families with children. 12 million working families receive a larger child tax credit, including 5 million previously ineligible families.

Read about: the Child Tax CreditRead about the Child Tax Credit: http://wh.gov/jmb

-

Launched a Federal Taxpayer Receipt to help American taxpayers understand exactly how their federal tax dollars are being spent.

Read about: the Federal Taxpayer ReceiptRead about the Federal Taxpayer Receipt: http://wh.gov/Qa5

What's Next

-

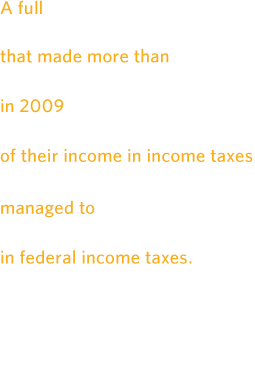

Ensure the wealthiest Americans do their fair share by paying at least the same tax rate as middle class families so we can reduce the deficit in a balanced way while preserving investments in education, clean energy, manufacturing, and small businesses.Read about: balanced deficit reductionRead about balanced deficit reduction: http://wh.gov/UNjo

Related Blog Posts

- April 15, 2013 at 5:53 AM EDT

White House Taxpayer Receipt

- January 5, 2013 at 7:00 AM EDT

Weekly Address: Working Together in the New Year to Grow Our Economy and Shrink Our Deficits

- January 4, 2013 at 11:13 AM EDT

White Board: Here's What's in the Taxpayer Relief Act of 2012

- January 3, 2013 at 7:54 PM EDT

White House Office Hours: Agreement to Extend Middle Class Tax Cuts

- December 21, 2012 at 10:25 PM EDT

President Obama Discusses the Fiscal Cliff

- December 20, 2012 at 4:24 PM EDT

The House Republicans’ Spending Reduction Act of 2012 Will Hurt Middle Class Families