|

Revenues

Where does the City get its money?

Total City revenues for Fiscal Year 2015-16 are expected to be $98,798,270 — a decrease of $3,254,123 or 3% from the prior year’s revenues. Revenues by fund for the City are projected as follows:

General Fund

Pays for core services like public safety, parks and recreation, community development, and public works. Revenue for this fund comes primarily from property and sales tax, franchise fees, and charges for services.

Special Revenue Fund

Accounts for the proceeds of special revenue sources legally restricted to expenditures for specific purposes.

Debt Service Fund Pays principal, interest and associated administrative costs incurred with the issuance of debt instruments.

Capital Projects Fund

Pays for the acquisition and construction of major capital facilities from General Fund revenues.

Enterprise Fund

Pays for specific services that are funded directly by fees charged for goods or services.

Internal Service Fund

Pays for goods or services provided amongst City departments or governments on a cost reimbursement basis.

|

Property Taxes

For every dollar collected in property taxes, agencies receive a portion per the following breakdown:

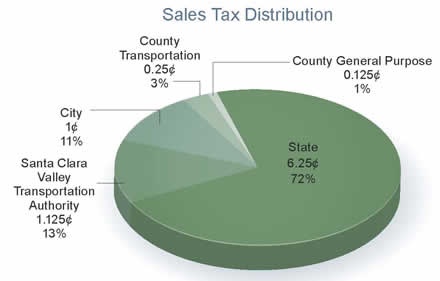

Sales Taxes

For every dollar you spend, you are taxed 8.75 cents. Agencies receive a portion in the following breakdown:

Expenditures

How does the City spend its money?

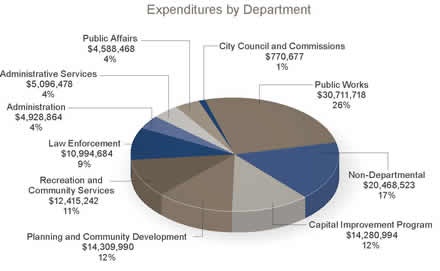

Final Budget Appropriations for Fiscal Year 2015-2016 were adopted at $118,565,638, an increase of $910,774 or less than 1% from the prior year’s Final Budget. The City allocates appropriations by department as follows:

|

|

|

Last updated: 8/27/2015 11:46:01 AM